May 7, 2021

“Disappointing”

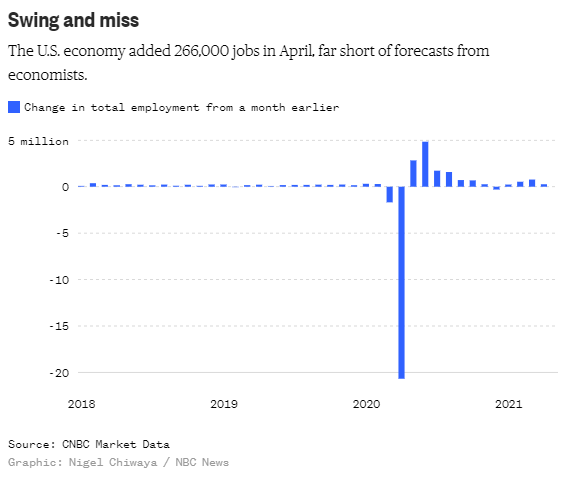

Today saw the release of the BLS’s Employment Situation Summary for April, and the release landed as softly as a bag of bricks. While forecasters generally expected an increase of 1 million in nonfarm payrolls, April saw a measly 266k jobs added, with March’s figure revised down as well. This prompted some clarification at the highest levels. President Biden took time during his remarks (skip to about an hour in) to “remind everybody” that the American Rescue Plan “was designed to help us over the course of a year, not 60 days, a year”. And Secretary Yellen explained that “starting up an economy after a pandemic… is going to be a bumpy process”. She assured listeners that, having “watched data for a long time”, “one should never take one month’s data as an underlying trend”. Noted, we will file that alongside the idea that the plural of anecdote isn’t data. But for those trying to get a read on the pace of the recovery, what does this stinker of a print mean? Does this indicate more stimulus is needed, and needed yesterday, or is it an indication that things are going well but are overly constrained?

“Challenged at every level”

The latest ISM data, both from manufacturing and services, appear to, metaphorically speaking, cast their vote for the latter. The ISM’s Manufacturing PMI dropped 4 points in April, but appears to have done so only due to constraints. As Tim Fiore, Chairman of the ISM Manufacturing Survey Committee noted, “record-long lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products are continuing to affect all segments of the manufacturing economy”. Fiore also said that “worker absenteeism” and “difficulties in filling open positions continue to be issues that limit manufacturing-growth potential”. This sentiment was echoed in the ISM Services survey, which also dropped slightly in April, retreating 1 point from the previous month’s all-time high. Anthony Nieves, Chairman of the ISM Services Survey Committee commented that “production-capacity constraints, material shortages, weather and challenges in logistics and human resources continue to affect deliveries”. Going further, one Services Survey respondent said that the” supply chain is challenged at every level”.

“What is to blame for the disappointing data?”

So, if the labor market is indeed constrained, what’s holding it back? Some are quick to point to the expansion of unemployment benefits (which Powell himself hinted at in last week’s FOMC press conference) and some states are already acting on this idea and paring back benefits. However, as the Financial Times writes, there could well be other reasons. The FT notes that both volatility and “fulsome” government support could be underlying causes for the weak print. However, the FT also reminds readers that “reconfigured family situations”, parents (especially women) staying at home to take care of children, and the continued spread of coronavirus could all be “hindering” the unemployed in “their capacity to return to work”.