“Not quite”

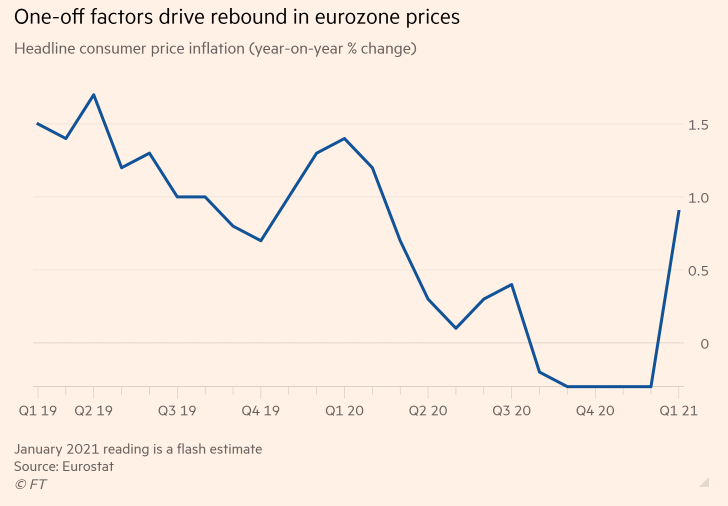

Last week, we highlighted Powell’s comments on inflation and how the projected inflationary pressures were not expected to be “either lasting or particularly large”. This week the tradition of “looking through” changes in inflation continues, this time in regard to the HICP. (Aside: Super Mario is making headlines again with his recent (re-)entry into Italian politics) As noted in an article from the FT, Eurozone inflation saw the “fastest jump in more than a decade” “driven by a combination of one-off factors”, including supply chain disruptions and increases in shipping prices.

As another article from the FT also notes, there are additional reasons the HICP readings are potentially dubious. Beyond the normal January confusion due to “an annual revision in the weightings”, Claire Jones argues that the recalculated basket will not reflect actual price pressures, thanks to “drastically” altered spending habits courtesy of the pandemic. Her data leads her to be suspicious that “the fall in inflation was overdone” and the 2021 basket “could have the opposite problem”. In any case, the difficulty of finding a reasonable basket highlights Jones warning that “the readings bear a fuzzier relationship to reality than usual”.

“Sooner or later you’re going to do the impossible”

While there may be reasons to believe that the reported numbers are fuzzy (the next round of CPI data is released Wednesday…) there is an increasing chorus of big names talking about inflation.

Stan Druckenmiller took some time to address the topic in a recent interview with Goldman Sachs, stating his “overriding aim is inflation relative to what policy makers think” and that he has constructed his portfolio to “play potential inflation”. Druckenmiller also discusses the potential for rising bond yields to challenge growth stocks but believes that increased Fed friendliness means some of the FANG names “could keep going”.

GMO’s Jeremy Grantham, whose blog post, “Waiting for the Last Dance”, we discussed here, also discussed price rises in a recent Bloomberg interview. During his discussion on bubbles and market excesses, Grantham said that he was worried about inflation, and “couldn’t help but notice that commodity prices around the world… are going up”.

P.S. It appears that the enthusiasm in the housing market continues into 2021, with a Redfin economist reporting he expects “bidding wars, fast sales and double-digit price growth to continue”.