“They have never seen such chaos”

We’ve been following auto manufacturers for some time as a canary in the coal mine for US supply chains, and this week, Tesla joined the list of “idlers”, announcing it will “temporarily halt some production at its car-assembly plant in California”. This shouldn’t be all too surprising considering the ongoing tightness in semiconductors, but as the article from Bloomberg explains, semis aren’t the only problem facing the car maker. In addition to the semiconductor shortage, “capacity issues at ports” are affecting the company’s supply chain. This is corroborated by this article in Supply Chain Dive, which highlights challenges at West Coast ports. Thanks to a spike in imports and a “reduction in staff related to the COVID-19 pandemic”, ports are seeing congestion and a backlog that could “continue into the summer”. But even if both the semi squeeze and port congestion abate, car companies may not be completely “home free”. As Reuters reports in a recent article, steel is “in short supply” and “prices are surging” with unfilled orders for steel in the last quarter “at the highest level in five years” and inventories at multi-year lows”. Among those the article mentions as having been affected by the shortage are companies that supply components to “automotive companies”.

“View it as likely to be transitory”

While the supply chain problems help the “case” for inflation, policymakers remain undaunted. First, Powell reiterated in his testimony to Congress that the Fed was not overly concerned and didn’t expect to be “in a situation where inflation rises to troublesome levels”. Second, this week, Bill Dudley offered “Four Reasons Not to Worry About U.S. Inflation”. In his article, the third act of the play in which he has so far given Five Reasons and then Four More Reasons to go ahead and worry, Dudley takes the time to explain why inflation won’t “spiral out of control or soon undermine the post-pandemic recovery”. In short, Dudley points to remaining spare capacity, the slow-moving nature of inflation, anchored inflation expectations, and Fed tools as reasons not to be alarmed. He is even kind enough to describe the stages leading to higher inflation and higher interest rates, but despite encouraging readers not to fret, he does warn that this transition “will likely be painful for financial markets”.

“Not a dire prediction of imminent danger”

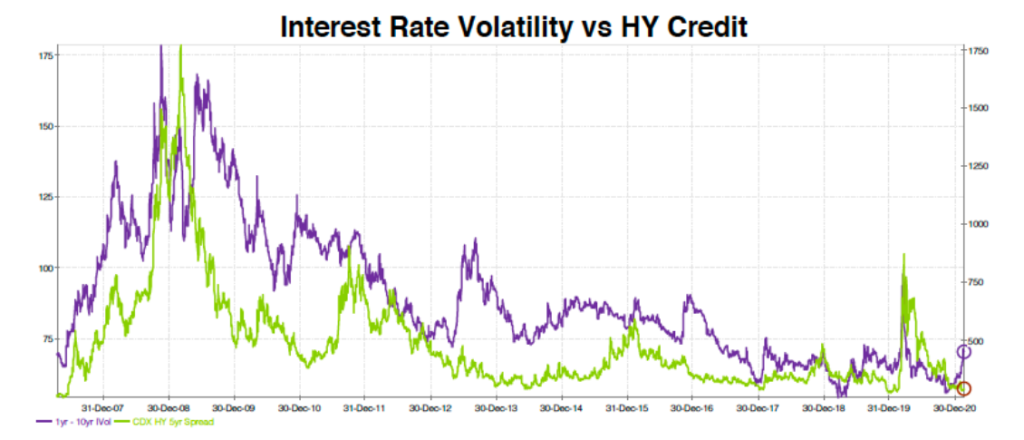

Finally, amid arguments about the exact nature of the dynamics behind this week’s erratic bond moves, which saw the ECB and others respond with increased bond buying, Harley Bassman walks through how he seeks “Treasure with Convexity”. In addition to discussing topics such as delta and gamma (aside: GameStop’s stock was moving again), he explains why he believes implied volatility is too low and why its going up could place the High Yield sector at risk.