When it comes to making predictions about the economy (or the future), even the pros can have a hard time. As Jerome Powell said in the January FOMC Press Conference “the path ahead remains highly uncertain”. But while it may be dangerous to rely on the wisdom of crowds, this week we can turn to recent surveys to see what professional forecasters, small businesses, and consumers expect to unfold.

“A brighter outlook”

Today’s Philadelphia Fed’s Survey of Professional Forecasters reported that those surveyed had a stronger outlook for the US economy over the next few years. The panelists saw “a stronger rebound in output growth”, “a brighter outlook for the unemployment rate”, and a “lower risk of a negative quarter in 2021”. The report was, however, not without some head scratchers. While the forecasters shifted their estimates for unemployment down, they also shifted their forecast for job gains down. Additionally, on the inflation front, forecasters upped their expectations of headline CPI for this quarter by half a percent, and their projections for headline and core CPI and PCE were all either “revised upward slightly or held steady”. Forecasters joined Redfin in expecting higher House Prices, though their expectations of year-on-year growth seem staid when juxtaposed with the NAR’s latest readings, which showed home prices “rose at the fastest pace on record”.

“Many important factors… are still unclear”

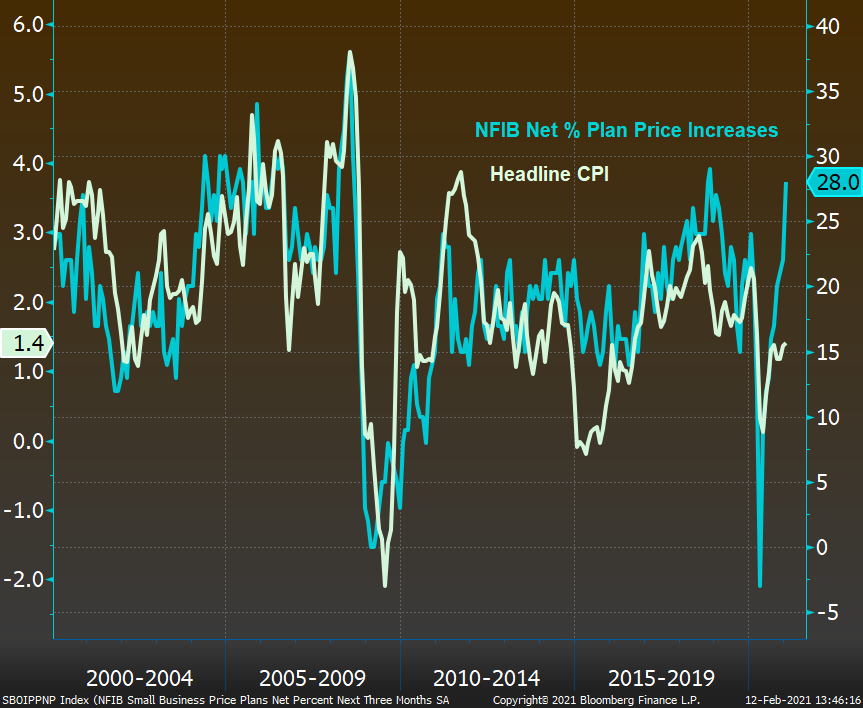

The latest NFIB Small Business Optimism data provides an alternative look. In the “Key Findings”, the NFIB noted that the “Uncertainty Index decreased 8 points to 82”, and the comments were optimistic that “owners will have a much clearer picture of the future business environment soon”. But in the meantime, “the net percent of owners expecting higher real sales volumes decreased 2 points to a net negative 6%, overall”, which the report noted was “not a positive picture”. And yet, “a net 28 percent plan price hikes (up 6 points)”, with 40 percent of wholesale respondents having already hiked prices”.

“Depends on a significant reduction in precautionary motives”

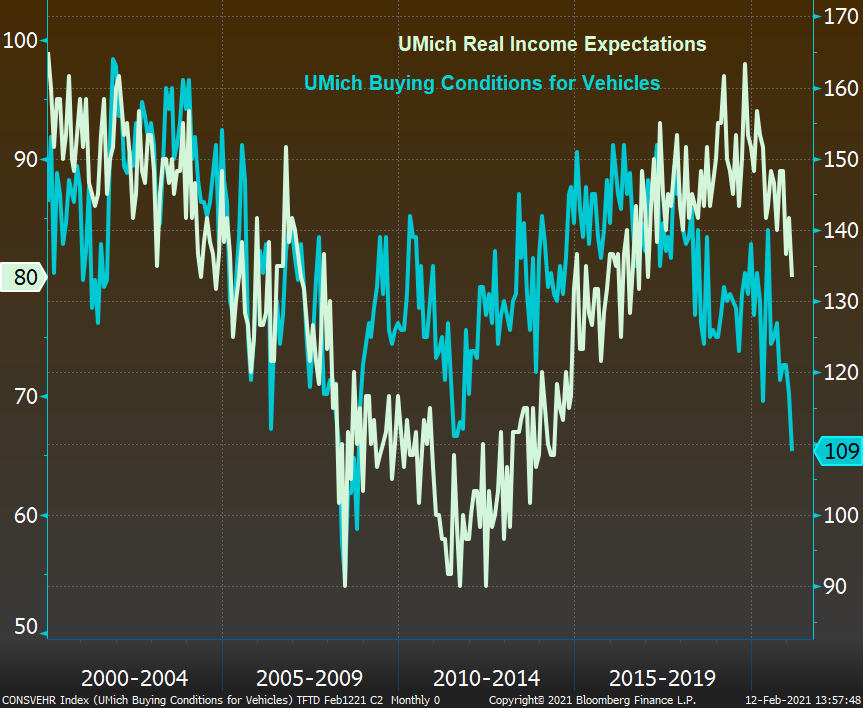

The title of this section comes from the latest University of Michigan Survey of Consumers. The overall Index “edged downward”, “with the entire loss concentrated in the Expectation Index and among households with incomes below $75,00” (K-shaped recovery anyone?). Expectations for Real Household Income continued its decline, expectations for both short-term and long-term inflation jumped, and sentiment regarding Buying Conditions for Vehicles hit the lowest levels since 2008.