“Continued optimism about growth”

While all may not be quiet on the Western Front, this past week, there is some comfort in the idea that it’s simply the usual suspects. A new equity market entrant is getting an impressive valuation. Elon Musk is tweeting about a meme coin. And inflation is continuing its steady march upward. CPI beat forecasts and was supported by a variety of other data. Both Import and Export prices saw large year-on-year jumps, and surveys reported high levels of both current and expected inflation. The Empire Fed’s prices paid index was the highest since 2008, and the prices received index was a record high, “indicating that selling prices increased at the fastest pace in more than twenty years”. Meanwhile, the Philadelphia Fed manufacturing survey’s 6-Month Forecasts for Prices Paid and Prices Received both hit 30+ year highs.

“A discouraging scene”

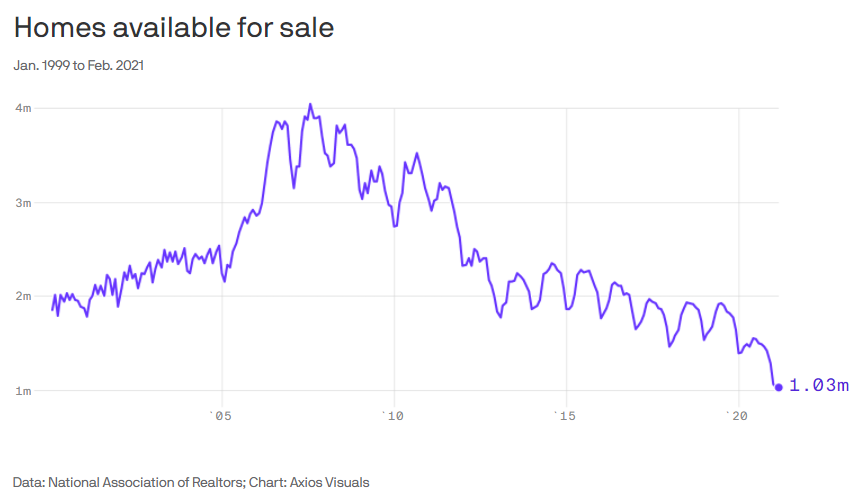

Looking at some of the particular points of price pain, it is once again the usual suspects. Lumber, housing, and semiconductors continue to be an issue. While Joe Weisenthal has an all-caps solution to the lumber shortage in the form of building more homes, lumber has “gone up more than 180 percent since last spring” and is adding tens of thousands of dollars to the price of single-family homes. The supply crunch is forcing some contractors to get creative to source material or have consumers buy lumber for their own projects, warning “supply could be gone before your contractor starts”. These factors bode ill for those looking for some relief in the price pressures that have continued to dog housing. As Axios notes in its article on “The dispiriting housing boom”, extremely low inventory, low mortgage rates, and strong demand have lead to some remarkable dynamics, including a 40% rise in the median listing price in Austin, Texas. “The bottom line: Housing prices are likely to remain high and rising for a while yet.” And rounding out the list, are semiconductors, which remain in short supply. The industry continues to receive attention, with President Biden convening a meeting of industry executives to discuss solutions, but there appear to be no quick fixes in sight, and weather continues to add to production challenges.

“’Pandemic as war’ analogy”

But while price pressures continue to make themselves known, there is another reason, adding to those from last week, to be relaxed about inflation. In a recent report from Goldman Sachs, researchers studied inflation “in the aftermath of the world’s 12 largest wars and pandemics”. Though they cautioned that “averaging across a number of wars and pandemics can obscure important details”, their analysis showed that while wars result “in overheating and the destruction of physical capital”, “higher inflation is not a natural consequence of pandemics”.