“The importance of having well-anchored expectations”

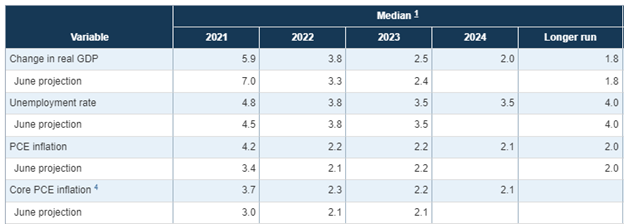

While most of the headlines following this week’s FOMC meeting were about tapering (the phrases “a moderation in the pace of asset purchases may soon be warranted” and “could come as soon as the next meeting” leapt out of the transcript), the debate about the anchoring of inflation expectations did receive some airtime as well. Whether or not Powell was aware of Larry Summers comments on the subject earlier this month, he provided a slight rebuttal. Answering a question about inflation projections showing “a couple of tenths of an overshoot”, he argued that “indicators of longer-term inflation expectations appear broadly consistent with our longer-run inflation goal of 2 percent”.

However, the Fed (unintentionally?) had an even more direct rebuttal in the form of the N.Y. Fed’s “Liberty Street Economics” Blog. In an article released today, Fed researchers ask, “Have Consumers’ Long-Run Inflation Expectations Become Un-Anchored?” and arrive at the conclusion that “the recent surge in actual inflation had little impact on the long-run inflation expectation of the median U.S. consumer”. In their analysis, they used “novel data” from the same Survey of Consumer Expectations (SCE) that Summers referenced, and they found that “the median long-run inflation expectation of consumers changed little over the past two years, but also that the entire distribution of long-run inflation expectations changed little”.

The researchers even performed “a series of experiments” to measure how sensitive inflation expectations were to “hypothetical shocks” and “hypothetical surprises” (Yes, what if?!). In all, the researchers concluded that “taken together, these survey findings provide evidence that even though the current surge in inflation has affected short- and, to a lesser extent, medium-term inflation expectations, it did not significantly affect the anchoring of long-run inflation expectations”. Dr Summers, a rebuttal?

P.S. A Fed staff working paper (“circulated to stimulate discussion and critical comment” and which doesn’t “necessarily reflect the views of the Board of Governors or the staff of the Federal Reserve System”) concludes that the belief that “households’ and firms’ expectations of future inflation are a key determinant of actual inflation” “rests on extremely shaky foundations” and “could lead to serious policy errors”.