… until they get punched in the mouth

If even the best laid plans can go awry, following plans when the going gets tough can add an extra layer of difficulty. Iron Mike cut to this point in his famous quote above, and his statement about boxers appears to apply just as well to markets and policymakers as they respond to the latest blows from data, policy shifts, and each other!

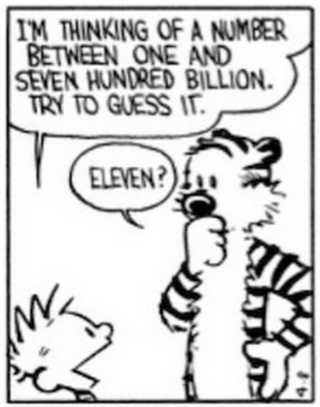

As the metaphorical punches continue to land, new plans are being hatched on the fly (similar to Calvinball). Case in point is the latest energy moves out of Europe. Having previously restricted or even shuttered coal power plants, a number of countries, including Italy, Austria, the Netherlands, and Germany, are revising their strategy in the face of ongoing difficulties sourcing natural gas (as discussed here) and the “risk of long-term gas supply shortages”.

Meanwhile, the hits keep coming in oil. Like Exxon, Chevron decided to respond to Biden’s letter, saying that it would prefer “clarity and consistency on policy matters”. But the Administration was unimpressed, lambasting Chevron’s CEO as “sensitive” and taking the initiative by proposing a Federal Gas Tax Holiday. Nonplussed, Speaker Pelosi appears to have opted not to support the idea, a sentiment echoed by some Republican lawmakers who said the idea was DOA. The Administration also encouraged states to take similar action to help consumers deal with the high price of gasoline; New York has implemented the idea already.

In a similar vein, the idea of direct stimulus to help deal with rising prices is starting to gain a share of mind. Policymakers in Austria are taking action with a €6 billion plan floated by the national government to help fight inflation, including a “climate bonus payment” of €500 that was recently passed. The UK is also headed that direction with “cost of living payments”.

Meanwhile, other economic punches continue to land. Amid an interview with an “official Tesla recognized club”, Elon Musk said that “Both Berlin and Austin factories are gigantic money furnaces right now” thanks in part to “tiny” production numbers arising from “challenges in boosting production” of its new batteries while the tools for making its conventional batteries are “stuck in port in China”. (Tesla has also joined the layoff ranks with Musk saying that “a 10% cut in salaried staff at Tesla will happen over three months.”)

The heat in the housing market also appears to be ramping up. JP Morgan joined the layoff ranks, having announced it is laying off or moving more than 1,000 employees in its mortgage business as “a result of cyclical changes in the mortgage market”. Meanwhile, Lennar has “started trimming prices and offering buyer incentives” as the Fed’s actions “have begun to have the desired effect of slowing sales in some markets and stalling price increases across the country” (an intended consequence). Moreover, given the current market conditions and mortgage rate moves, the company’s Executive Chairman warned that “current attempts at guidance are tantamount to ‘guessing and not ‘guiding’”.

P.S. While the latest Fed Speak appears rosy and optimistic (Powell said that the economy “is well positioned to handle tighter monetary policy”), tangential sources aren’t so optimistic. A recent research piece on recession risk found that while “the term spread does not suggest much risk of a recession over the near future”, “the low level of unemployment and high level of inflation suggests a higher risk of a recession over the next year or two”, i.e. “a sizeable risk” above 50 percent “over the next four quarters” or a probability of “about 67 percent over the next two years”. Bill Dudley was starker in his analysis, writing that “a recession is inevitable within the next 12 to 18 months”. “Much like Wile E. Coyote heading off a cliff, the US economy has plenty of momentum but rapidly disappearing support. Falling back to earth will not be a pleasant experience.”