“It means different things to different people”

Bill Clinton is perhaps the poster child of definitional sophistry, having famously pondered “what the meaning of the word is is”. The Fed hadn’t been quite so coy with the word transitory, but this week, in the post-FOMC press conference, Jerome Powell finally gave a full definition. Though Powell said, “transitory is a word that people have had different understandings of”, he clarified that for the Fed “transitory” inflation means “it will not leave behind it permanently or very persistently higher inflation”. Got it; a bit of a stock vs flow argument. But while Powell may have helped provide some linguistic clarity, he was not let off scot-free. In addition to being asked about the Fed trading debacle that led to new rules, he was also asked about other sensitive subjects. Regarding “the difficulties that high inflation poses for individuals… especially those with limited means”, Powell said the Fed understood “completely” the plight of those “seeing higher grocery costs, higher gasoline costs, when the winter comes, higher heating costs for their homes”. What’s more, “given the long and variable lag with which monetary policy works”, Powell was asked if he was concerned the Fed was going to be forced “to raise rates faster and farther” than they would like, especially given its “forecast has been chasing inflation over the last year”. Powell rebuked the idea, saying he didn’t think “that we’re behind the curve”. Markets appear to believe Powell as far as rate hikes go, with markets pricing in fewer rate hikes in the second half of next year. Still, a couple of grains of salt might be in order given his statement that persistent inflation and bottlenecks were “not expected by us, not expected by other macro forecasters”.

“Well into, if not through, 2022”

At the same time Powell provided clarity on the word “transitory”, incoming data showed that supply chain issues and inflation continue to be anything but. Labor costs are surging, with ULC rising in Q3 at an annualized rate of 8.3%. Car prices continue their upward trajectory. And the UN warned on food prices, with their global index hitting the “highest level since July 2011”. Meanwhile, fertilizer shortages “could threaten global crop yields”, as Russia joins China in restricting exports, and wheat prices are at “their highest levels in years” amid strong demand and drought “across the Northern Hemisphere”.

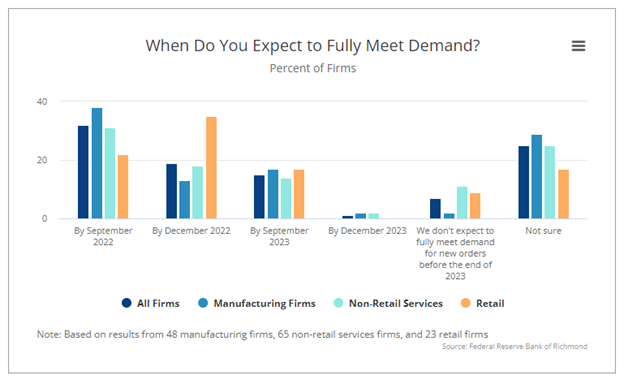

Admittedly, there are some glimmers of improvement. Cattle ranchers are taking matters into their own hands and are looking to build their own meat processing plant as they look to avoid last year’s hiccups. However, even the Fed’s data, this time analysis of a survey from the Richmond Fed, shows that “only about 50 per cent of firms expect to be able to meet demand by the end of 2022”.