“Declines were offset by increases elsewhere”

While the title of this week’s newsletter may seem like the answers to a bizarre Mad Lib, they are instead adjectives used to describe some of the latest economic data that the Fed will likely have their eye on ahead of their next meeting.

First, and on the rather sticky side, were this week’s CPI readings. The YoY reading in Headline CPI dropped slightly, going from 8.5% in July to 8.3%, but there was little else to give the Fed comfort that rate hikes are gaining traction (long and variable lags?). The monthly readings for both Headline and Core not only rose but exceeded expectations, and Core’s YoY reading also marched higher at the same time it beat expectations, climbing to 6.3%. There were some areas that saw significant price drops, including energy prices, “led by a 10.6% slide in the gasoline index”, and airline fares were “off 4.6% on the month though still 33.4% higher than a year ago”. However, while commentators may be quick to split hairs of the individual components, the Fed’s own aggregates are perhaps worth noting. As the Atlanta Fed’s “Underlying Inflation Dashboard” comments, “Monetary policymakers have historically used or monitored various measures of underlying inflation to gain context about longer-term trends” and in the latest numbers from those various measures, the Fed will find no repose. None of the metrics among their list is less than 2% above target, and many are probing multi-decade highs.

There may be some hope that inflation will moderate going forward, with the rise in producer prices slowing, which is mirrored in the price data in the latest Empire and Philly Fed surveys.

“An interesting thing that is now starting to surprise a lot of people”

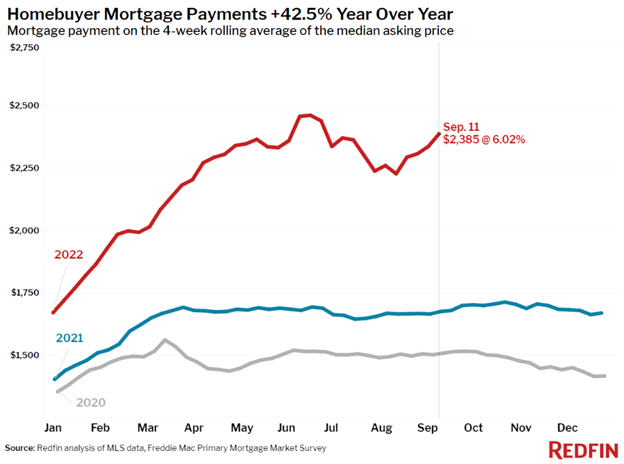

Second, and the source of “balanced” as the operative adjective, is housing. While the word balance itself may carry some positive connotations, arriving at the point of balance is not always a painless process. As Redfin’s recent research explains, “high mortgage rates have brought balance to the market, but it comes at a high price for both buyers and sellers.” The article further clarifies that while the “rapid climb in months of supply” has meant “homebuyers have more power”, “it’s increasingly hard for buyers to make use of their newfound power thanks to the affordability pressures of rising mortgage rates and a dearth of homes being listed for sale”.

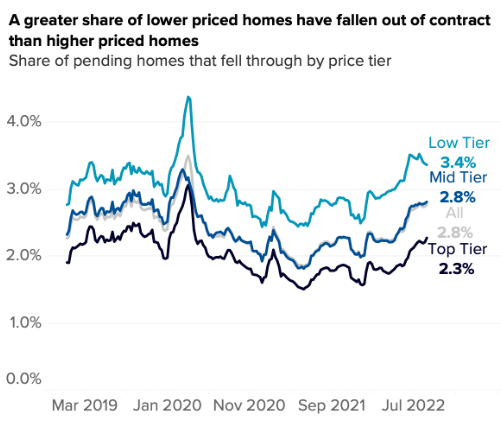

Zillow’s latest article agrees, positing that the “quickly rebalancing market – brought about by sharp increases in mortgage rates… has caused homebuyers and sellers to reset their expectations”, which has, in turn, lead to “a recent increase in the share of pending sales that fall through”. Despite the rise in cancellations, the article does include (in its title, no less) the cheery notice that there is, so far, “no need to sound the alarms”. However, as an article from Fortune explains, Zillow’s own predictions on the number of regional housing markets that will see declines in the next year have steadily risen (and have come with a commensurate decline in Zillow’s 12-month outlook for the change in home values).

P.S. Corn headlines show that the situation in global agriculture continues to be rocky, with forecasts that European corn production will “fall to a 15-year low” and drought in Argentina leading to “the worst planting scenario for corn in the last 27 years”.