While unintentional, the Fed has made itself the source of a number of amusing market “memes”, including “thinking about thinking about ______” and the idea of “substantial further progress”. Joking aside, there remains some confusion about what exactly “substantial further progress” is. This was demonstrated by Steve Liesman, who asked a question on the subject during last week’s FOMC press conference. Powell’s response was to highlight that the labor market had some ground to cover and to frame inflation as above target but transitory. Since then, we’ve had an onslaught of Fed comments and clarification.

Jim Bullard was the first to chime in after the meeting, saying last Friday that the Fed was “tilted too much to the dovish side”, arguing that the Fed should start reducing its bond purchases this fall and cut them “fairly rapidly”.

Lael Brainard, speaking last Friday as well, toed Powell’s line, saying that “employment has some distance to go” and that “the determination of when to begin to slow asset purchases will depend importantly on the accumulation of evidence that substantial further progress on employment has been achieved”. Brainard did however hint at timing, saying she’d expect “to be more confident in assessing the rate of progress once we have data in hand for September”.

Newcomer to the Fed, Christopher Waller was even more optimistic on Monday, expecting strong jobs reports for July and August and believing that such prints should lead the Fed to “go early and go fast” with tapering.

Clarida, the “Federal Reserve’s number two official” also voiced expectations “for a steady labor market recovery”. While reiterating the Fed’s dependence on data over forecasts, saying it would serve the Fed well “to remain humble in predicting the future”, Clarida said that, should his expectations on inflation and unemployment be met, “commencing policy normalization in 2023 would… be entirely consistent with our new flexible average inflation targeting framework”.

Also speaking on Wednesday was Dallas Fed’ Robert Kaplan. Kaplan appeared to be in Waller’s camp, saying that if July and August jobs numbers showed progress “I think we’d be better off to start adjusting these purchases soon”. Kaplan did, however, take the time to make a distinction between tapering and raising rates, clarifying that “my comments on purchases are not intended to suggest I want to take more aggressive action on the Fed funds rate”.

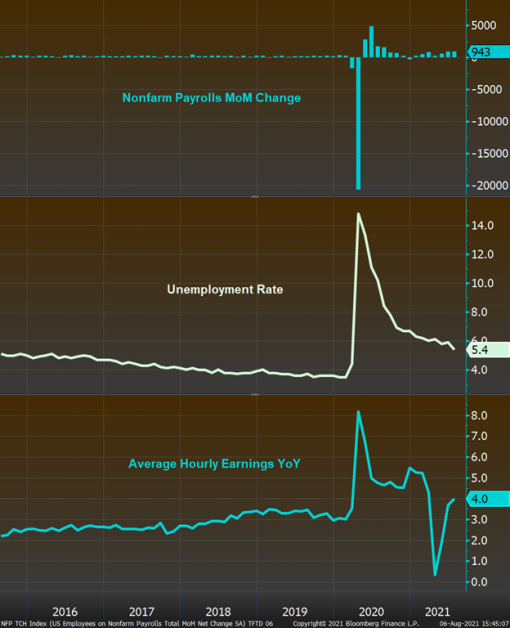

Today’s 943k NFP print likely fits the “strong” bill and it will be interesting to see if and how Fed messaging evolves as we head into Jackson Hole later this month.

P.S. Following on his commentary regarding the Fed last week, Mohammed El-Arian has upped the ante, warning in an article this week that the Fed running unnecessarily easy monetary policy for too long “could hurt both the economy and Biden’s agenda”, arguing that “an ultraloose monetary policy stance is no longer part of the desirable policy response”.