“Will… include some pain”

In a relatively brief interview from last week, Jerome Powell made a number of statements that seemed to put markets and market spectators on edge. Though he successfully dodged a question on the prospect of a 75-basis point hike, he not only admitted that it would “have been better for us to have raised rates a little sooner” (Bernanke recently opined that the delayed response to inflation was “a mistake”), but went as far as to admit that achieving the goal of a soft landing “may actually depend on factors that we don’t control”. The admittance that the FOMC is not economically omnipotent aside, the real sticking point for Powell, which he emphasized repeatedly, was the state of the labor market. Directly linking the job market to inflation and noting that “price stability is the bedrock” of the economy, Powell said in no uncertain terms that the goal will be to get the labor market “much closer to being in balance” and said in principle one could “moderate demand, reduce demand to the point where job openings move down substantially”. How much demand will need to be curtailed to reach that objective remains to be seen as JOLTS job openings are at “the highest level since the series started in 2000” and the spread between openings and hires is roughly 5 million.

If taking air out of the labor market indeed the goal, there are some green shoots for Powell and co. (noxious weeds for the labor market) to be found in recent headlines. Amazon is reportedly trimming its hiring plans after announcing earlier that it was “no longer chasing physical or staffing capacity”. Carvana announced that it is laying off 2500 people. And while it pales in comparison to any of the 2020 prints, the latest Initial Jobless Claims number is the highest since January and was 9% higher than forecasted.

Additionally, while there’s many a reason to remind ourselves that the plural of anecdote isn’t data and one month’s data isn’t “an underlying trend”, sometimes little things do indeed add up. With that in mind, it’s worth perusing a variety of recent data that indicate that just as Powell and team are trying to put the kibosh on the labor market, other parts of the economy are beginning to show weakness. As the WSJ notes here, it appears “that the healthiest consumer lending environment on record in the U.S. is coming to an end”. As evidence, they note that “the share of subprime credit cards and personal loans that are at least 60 days late is rising faster than normal”. What’s more, “delinquencies on subprime car loans and leases hit an all-time high in February” based on data that goes back to 2007.

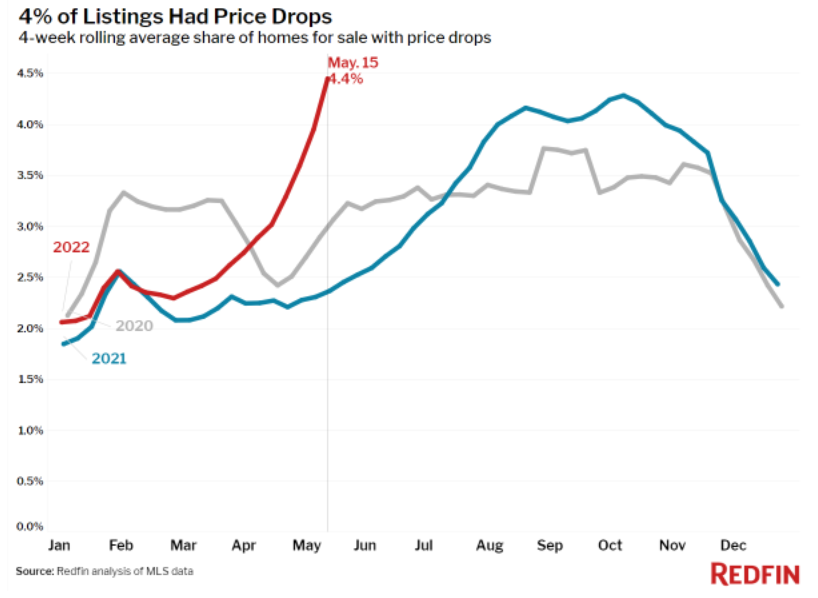

Meanwhile housing had been seemingly undaunted by the combination of high prices and higher rates, but the daunting may have begun. Though Redfin’s data showed remarkably strong price increases continue apace, their latest headline highlights that “Sellers Rush to Find Buyers Before Demand Weakens Further”. This was corroborated by a 2.5-year high in the number of listings for sale with price drops and touring activity “was 25 percentage points behind the same period in 2021”.