“The pace of declines seems to be gradually attenuating”

If next week can be characterized as an inflation data deluge, with PPI and CPI, this week we have a flood of employment data. Ahead of tomorrow’s NFP and Unemployment, we have several releases indicative of a souring labor market. The “divergent story” in employment, which saw JOLTS openings tell a different story than “other market indicators”, has been negated as the latest numbers from the BLS saw the total openings number dropping below the 10 million mark for the first time since May 2021. Additionally, initial claims came in above expectations at the same time that last week’s numbers were revised higher. This comes with a bit of a caveat in that “the Labor Department updated the methodology used to seasonally adjust the initial claims and the so-called continued claims data”, flip-flopping from “additive factors” to “multiplicative models”. Meanwhile, though LinkedIn’s April Workforce Report noted that “modest hiring declines continue”, the company’s head of macro took to Twitter to note “that the pace of declines [in hiring] seems to be gradually attenuating” and that he was crossing his fingers “that this continues”.

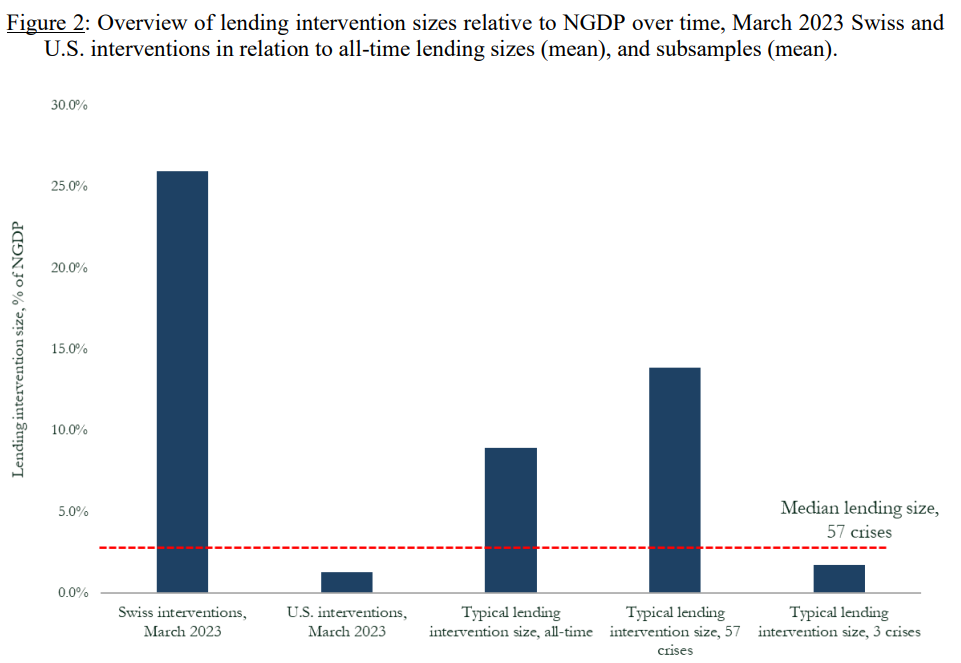

“The vast majority of events … ultimately evolved into ‘systemic’ bank-distress episodes”

If the various sources discussed last week didn’t provide enough evidence “that the effects of banking accidents are unlikely to be contained to the banking sector”, there’s also historical experience to consider, and for that, we can turn to a recent paper. Looking at a “new long-run database on banking-sector policy interventions over the last eight centuries” (yes, a database of “almost 2,000 interventions covering 138 countries over 750 years”), the authors conclude that the recent fireworks are likely not over just yet. Though they admit that “the particular combination of policy interventions seen as of this writing… indicates a rather unusual response pattern”, the outlook is not positive. Not only does past evidence suggest “that these interventions may yet grow substantially further in size, and could reach new all-time records”, but additionally, given the response mix, the data “suggests that a substantial share of distress events over time showing the presently unfolding intervention pattern eventually assumed ‘systemic’ crisis dimensions, an outcome associated with meaningfully higher financial and real economic costs and dislocations”. It ain’t over until the Central Banker intervenes to stop a systemic event? “… Past patterns indicate that lending interventions may yet significantly grow in size in the present distress episode, as they remain less than half of long-run averages”.

Alternatively, here’s a longer paper on Credit Crunches and the Great Stagflation, in which the authors look into credit crunches and cover how regulations and rising Fed Funds rates “triggered large outflows of deposits from banks, resulting in a series of credit crunches”. Related: “Loan demand declined for the fifth period in a row as bankers in the March survey reported worsening business activity”. Anecdotally, it looks like VC firms are opting to go more heavily toward the equity rather than the debt route to fund their activities/takeovers, which implies that the latter route doesn’t quite offer the cushy ride it used to.