“… so far”

While “so far” may sometimes come with “so good”, the “so far” we are interested in this week comes from this latest FOMC presser. Powell used it to conclude his response to a question about the UBS takeover/rescue of Credit Suisse, stating that he “would say that that is going well so far”. Instead of “so far, so good”, is the chairman taking a page out of Homer Simpson’s book and admitting there’s room for things to get worse? Indeed, Powell addressed the ongoing bank problems and tightening credit conditions several times, including in his opening statements, saying the FOMC would “carefully assess the actual and expected effects of tighter credit conditions on economic activity”, reiterating that “the events of the last two weeks are likely to result in some tightening credit conditions for households and businesses and thereby weigh on demand on the labor market and inflation”. For households, CNBC has a recent handy article about how to prepare for a “credit crunch”. Yet despite the potential for credit tightening, Powell continued to try to reassure listeners and markets that US banks would be just fine and that the Fed would act to (i)/(e)nsure financial stability. Ironically, while Powell was working to calm the market’s nerves, Janet Yellen was staging a bizarre sideshow. Having just the day before insinuated that the Fed would ensure depositors remained whole, at the same time Powell was passing along his assurances, the former head of the FOMC made the mistake of telling the truth, saying that there were no plans to extend the FDIC insurance limit, “I have not considered or discussed anything having to do with blanket insurance or guarantees of all deposits”. The problem with telling the truth is that it isn’t always palatable to the market. The markets did not miss Yellen’s message and sold off, leading to headlines such as “Did Yellen upstage Powell?”. Yellen has since backtracked her comments and said today that the Treasury was “prepared to take additional actions if warranted” to “ensure that Americans’ deposits are safe”, which to our deeply cynical ears sounds like a more ambiguous version of her previous admission.

“A very precarious position”

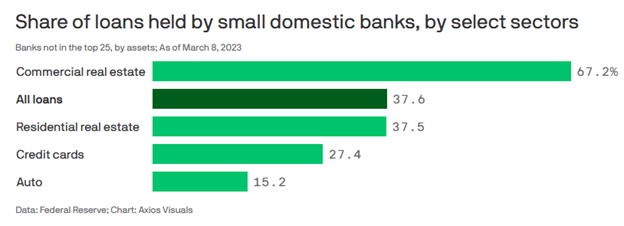

The nervousness around the health of regional and smaller banks and the problems we’ve been noting in CRE is attracting increasing attention. Recent coverage has highlighted that smaller banks hold “around $2.3 trillion in commercial real estate debt” or “almost 80% of commercial mortgages held by all banks” (or ~67%, depending on who you ask). As this article from the WSJ clarifies, “a large number of [CRE loan] defaults could force banks to mark down the value of these and other loans”. Eerily similar to the story we are hearing about the underlying cause of SVB’s collapse…

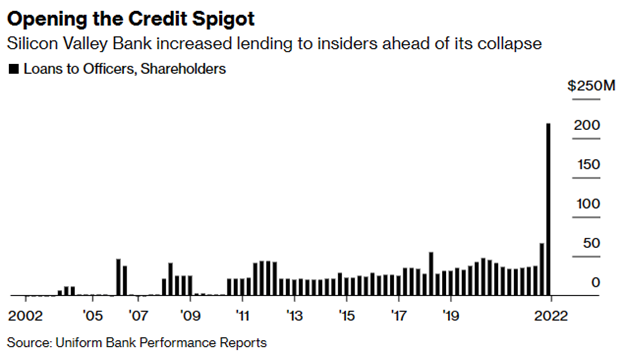

While we had (cynically) noted last week that it’s not impossible that some might have known about the tenuous health of SVB ahead of its collapse, there’s evidence pointing in the same direction. In addition to the Fed noting the existence of all of the elements that led to SVB’s demise in its minutes, i.e. susceptibility to runs, unrealized losses, etc. (and embarrassingly pointed out by Bloomberg’s Catarina Saraivain during the FOMC Presser), this week, the BoE’s Andrew Bailey took the Fed to task, explaining that the BoE had warned its US counterpart about the risk. Whatever happened to professional courtesy among Banking Supervisors? Also, adding to the “funny coincidence” pile for the suspicious is SVB’s behavior regarding “loans to insiders in months before its collapse”.

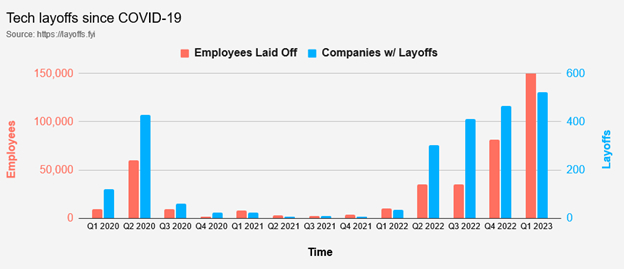

P.S. While Initial Claims came in today below expectations, “consistent with the robust labor market… [seen] in other metrics”, WARN data (as discussed in this paper from the Cleveland Fed) “warns” that Initial Claims may soon start to surprise in the other direction.

P.P.S. Accenture, Indeed, and Walmart all announced new layoffs this week.