“The cash flow… was insufficient to continue servicing its indebtedness”

For the last several weeks, we’ve been cheekily referring to real estate as a dumpster fire in discussing the ongoing problems in the sector; see here and here. For those who may take issue with this terminology, Yellen did recently offer an economic definition of a “fire sale”, and the Fed did itself use the term in the ‘shut the barn door after the horses have bolted’ paper entitled, “Non-Bank Financial Institutions and Banks’ Fire Sale Vulnerabilities”. “Dumpster fires” have a marginally more negative connotation than “fire sales”, but neither is particularly confidence-inspiring.

There’s no getting around the increasing use of the word “fire” in discussing the commercial real estate market that reflects negative trends. Case in point is the sale of the Union Bank building in San Francisco discussed a few weeks ago. The winning bidder paid $65 million at auction, “roughly 75 percent less on a per-square-foot basis than comparable building sales from just before the pandemic”. One might say that the silver lining is that this was $5 million more than expected (You’re still thinking about the bad news, aren’t you?). As the Hoover Institution’s optimistically titled “San Francisco Falls Further into the Abyss as Office Values Plunge 75 Percent” noted, “this is devastating news for San Francisco, because it provides a new market-rate benchmark for pricing other downtown commercial building listings”. Things don’t seem much better in L.A.

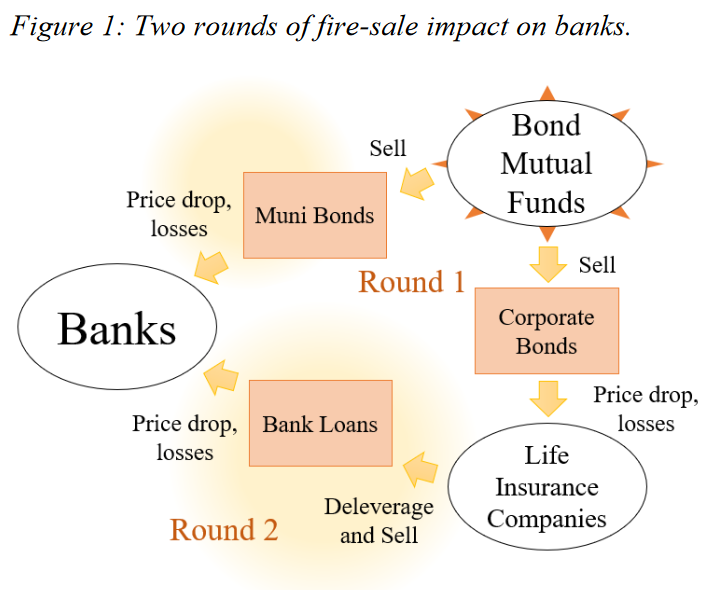

However, the companies involved in the sector would offer a more positive spin on the ongoing weakness as showcased in the recent article on New York commercial heavy-weights, “SL Green, Vornado plan office sales despite dreadful market”. (Ed: Should that read “because of dreadful market”?). Despite selling in an environment with New York City office sales down “a stunning 85 percent” from a year ago, both firms remain in the “glass half full” camp. SL Green’s CEO “acknowledged the tough sales environment” but noted that he thought “the market is coming around” and that the assets they’ve chosen to sell “are the right ones”. Meanwhile, Vornado was more defensive, the CEO saying, “We are not a distressed seller. We are not a weak seller… we are focusing on a very select pool of assets… where we consider ourselves to be offensive sellers”. Both companies will be using some of the proceeds from the sales for buybacks, using the justification that their “stock is selling at a discount relative to the value of its assets”: The current value. We wonder if New York may see a new and similarly ponderous “market-rate benchmark”. Did we mention that despite Elon Musk calling working from home “morally wrong”, it appears that “the return to the office has stalled”, “setting the stage for lower property-tax revenues and pressuring bars, restaurants and other small businesses that rely on five-day-a-week office workers”. If you are experiencing a strong sense of déjà vu, don’t worry, that’s normal. And in case you didn’t have time to peruse the NY Fed paper mentioned above, the authors’ conclusion offers something to keep in mind: “We have documented significant, and rising, exposures by U.S. banks to potential asset fire sales from nonbanks. Moreover, we have shown that banks are exposed to specific segments, even in the absence of meaningful asset portfolio overlaps”.

P.S. There was an energy fire sale in Finland, causing a newer nuclear power plant to dial back amid negative electricity prices.