“A half dozen central banks… followed suit”

This week saw a veritable smorgasbord of central bank activity, with Jerome Powell and the Fed taking center stage. While there had been some pricing in of a 100bps hike, the Fed delivered on the expected 75-point raise and reiterated that it anticipates “that ongoing increases will be appropriate”. Joining in on the hiking fun were several other central banks. The Bank of England opted for a 50 basis point hike (the result of a 5-4 split decision, with the dissent being a majority of votes for 75 and a lone vote for 25) and said that it would “respond forcefully, as necessary” to inflation despite estimates that the economy will have shrunk in the third quarter, meeting “the definition of a technical recession”. The SNB also went the 75-bps route, bringing rates back to positive for the first time since 2014 as inflation hit “its highest rate in three decades”. And other countries, including Norway, several GCC members (most of which have currencies pegged to the dollar), Indonesia, the Philippines, and Taiwan also raised policy rates this week.

“Rare and exceptional circumstances”

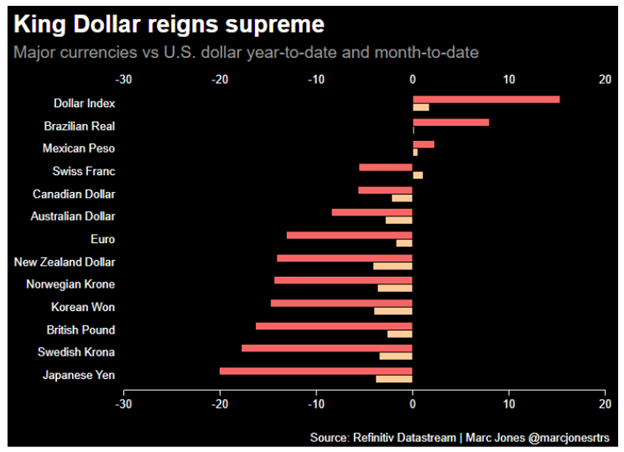

Despite the overwhelming move toward hikes, like the BoE’s vote, the metaphorical rate vote wasn’t unanimous. Turkey opted to cut amid 80% inflation, and the PBoC cut its repo rate (and “stepped up cash injections”). However, the most notable among the central banks opting not to hike was the BoJ. Though Japanese inflation is hitting multi-year highs and is, more importantly, above the BoJ’s stated target of 2% (and has exceeded the target “for five straight months”), the bank stood pat, choosing instead to hold interest rates “near zero to support the country’s fragile economic recovery”. This was not altogether surprising, with many thinking the BoJ “is unlikely to raise interest rates any time soon”. However, what may well have surprised many were the currency moves following the announcement. As the article from Reuters notes, following the “BoJ’s decision to stick to its super-loose policy stance”, USDJPY traded more than 1% higher, only to “plunge more than 2%”. The reason? “Japan intervened in the foreign exchange market on Thursday to buy yen for the first time since 1998”. Asked if policymakers had intervened, Vice Minister for International Affairs Masato Kanda said, “We have taken decisive action”. While the idea of currency manipulation may not exactly be the talk of polite company (Janet Yellen said recently that such acts are warranted only in “rare and exceptional circumstances”), there’s speculation, now that the seal has been broken, that the “race to rein in strong dollar is on”. This is perhaps not unwarranted, as “the dollar is up 16% this year against a basket of other major currencies, on track for its biggest annual jump since at least the 1970s”. Given that weaker currencies “can fuel imported inflation” and be “bad news for policymakers trying to contain price pressures”, putting a thumb on the scale may seem like a good idea, but as the cited article notes, interventions, “if not backed up by policy shifts, rarely make a difference”.