“Receiving no offers for the price they want to sell for”

In our first year of writing Thoughts From The Divide, we covered an “oldie but goodie” research paper from the 2007 Jackson Hole Symposium by Edward Leamer, titled “Housing Is the Business Cycle”. A few years on and with the latest minutes showing that the Fed “viewed the possibility that the economy would enter a recession sometime over the next year as almost as likely as the baseline”, it’s worth reconsidering Mr. Leamer’s conclusions to see just how the cycle is faring…

“… house prices are very inflexible downward, and when demand softens…, we get very little price adjustment but a huge volume drop”.

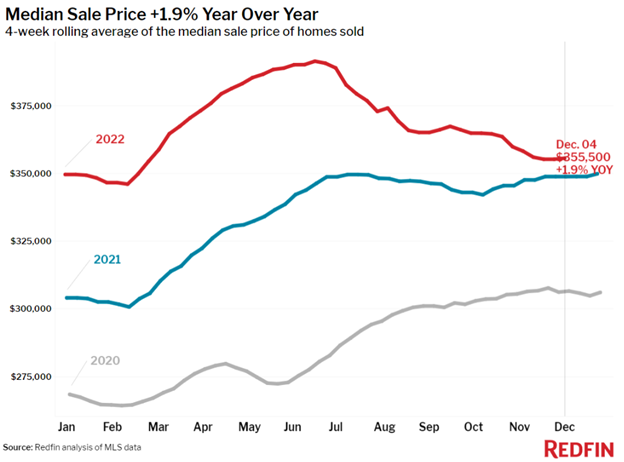

The latter part of Leamer’s conclusion appears to have already set in, with Pending Sales down roughly 35% YoY based on Redfin’s latest data. This is corroborated by a decrease in the number of new listings and an increase in median days on the market for sold homes. Or, more directly: Redfin’s Homebuyer Demand Index is down 29% YoY.

However, to the point on price, it’s a little bit of a “yes…, but…” dynamic. Yes, median sale prices are still up 1.9% YoY, and yes, there appears to be some stickiness in prices courtesy of delistings. Redfin notes that sellers are taking homes off the market because “they’re often receiving no offers for the price they want to sell for, and sometimes no offers at all”. But… prices are beginning to chill. This is seen not only in the cooling of the median asking price (which has dropped roughly 10% from its high earlier this year, a number echoed in Tweets from Rick Palacios Jr. of JBREC) but is expected to continue into the next year with Redfin forecasting that “home prices will post their first year-over-year decline in a decade”. (Related, as this Eye on Housing article shows, home builders are using incentives beyond simply reducing prices.)

While the Fed will likely be watching housing more indirectly thanks to its hefty weighting in inflation, Leamer concluded that

“… for the wiggles we call recessions and recoveries, residential investment is very very important”… “In words, residential investment consistently and substantially contributes to weakness before the recessions”.

Here, there is slightly better news. While Eye on Housing wrote that “private residential construction spending fell for the fifth consecutive month” in October, it is still “about 8.6% higher compared to a year ago”. Warren Mosler also noted the slight weakness, saying in his blog that it was “off a touch but this follows a very strong post-COVID spike”.

P.S. While Leamer’s conclusions don’t directly touch on REITs, the gating of the Blackstone fund doesn’t bode well.

P.P.S. There’s some hope that Europe will be able to find substitutes for energy inputs, but a recent F.T. article notes that the scramble has triggered “deep concern about the future of German industry”.