That we are watching this week for a number of potential U-turns is perhaps not surprising given what we’ve seen before in terms of Calvinball, Mike Tyson’s wisdom, and the friend vs foe distinction. However, it is still worth noting how many economic actors seem to be on the edge of an about-face.

“The gathering tsunami”

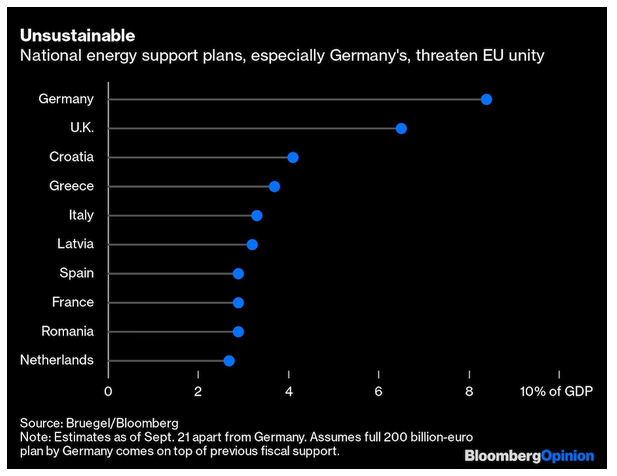

Our first potential U-turn is the stalwart and usually fiscally conservative Germans. Over the last week, there has been a “he loves me, he loves me not” dynamic as rumors fly that the German government will support joint debt “to cushion the blow of the energy crisis” amid “the gathering tsunami of soaring energy costs”. This rumor seems to crop up and be denied overnight, but in the meantime, Germany is working on its own plans “to ease pressure on consumers from surging gas prices”. The rumors also come as inflation and energy market problems continue unabated. Case in point, the final reading for German inflation came in at 10.0% YoY for September, marking the highest rate of price increases “in more than 70 years”, with the harmonized MoM reading of 2.2% itself blowing through the ECB’s 2% YoY target. Meanwhile, with some French regions beginning to ration fuel, the French Prime Minister “announced the government was prepared to use force” to order staff back to work if wage talks didn’t “bring about a solution”. This appears to have backfired, with the CGT union calling the plans “violent” and leading the union to suspend “all ongoing negotiations with government and employers on a national level and across business sectors”. The broader fuel situation is further complicated by a malfunction at “Europe’s largest oil refinery” where a compressor tripped “due to the loss of power supply”. Shell, the refinery owner, was upfront about the issue “but didn’t elaborate on what processing capacity was affected [n]or what it would mean for fuel supply”.

“Let’s see.”

There are also rumors of a policy U-turn in the UK. As BoE Governor Bailey told pension funds struggling to get their positions under control, “you’ve got three days left now. You’ve got to get this done”, referring to the end of the BoE’s bond-buying operations (which were expanded again…), there were rumors that Liz Truss’s administration would be changing its fiscal tune. While there were calls for Truss to “abandon the tax cuts and reductions in public spending” that had been on the table, a spokesperson for her administration “reiterated Truss’s commitment that overall government spending will rise in real terms this financial year”. Even as “the pound jumped against the dollar and UK borrowing costs fell… amid suggestions that the Government would reverse course”, Kwasi Kwarteng, Truss’s Chancellor of the Exchequer, the head of the Treasury, was pushing back on the rumors, even if mildly, saying that the government “remains committed to moving the economy from ‘exorbitant’ taxes and spending” and that he wanted to move to an economy “where we have lower taxes, more incentives, and more growth”.

P.S. Inflation’s hoped-for U-turn isn’t proceeding as quickly as some might like, with both PPI and CPI beating expectations.

P.P.S. Barge problems in the US continue to be a game of “Whack-a-Mole”, with new pressure points emerging just as others are eliminated.