“Back into balance”

While there was a variety of data this week, including the Fed minutes (discussed below), much of the headline space was devoted to the latest employment data, and it was notably mixed. November’s JOLTS job openings data beat expectations, coming in at 10.46 million, and had previous months revised higher. December Average Hourly Earnings were lower than expected at 4.6% YoY, but NFP at 223 thousand beat estimates. And Unemployment, following in JOLTS’s footsteps, was both better than expected (3.5%) and saw November’s reading revised lower. The latest ISM surveys also had mixed readings on the state of the US labor market. The ISM Manufacturing survey saw a reversal from contraction to growth, with a reading of 51.4. This came with a slight reduction in the number of times layoffs were mentioned and with one respondent saying that “skilled labor shortages are huge”. However, the report explained that some of the improvements in the employment readings and comments were “likely due to the holiday period”. Meanwhile, on the Services side, employment contracted, with the report stating the contraction was “due to a combination of decreased hiring due to economic uncertainty and an inability to backfill open positions”. The more dour outlook for Services employment was also seen in the ISM’s latest Semiannual Forecast, which reported that while the “manufacturing employment base is expected to grow by 3.9 percent”, “the services employment base is expected to increase by 1 percent in 2023”.

All of this may seem like hair-splitting, but the employment picture is very much on the mind of the Fed. As Bill Dudley explained in his op-ed, by keeping monetary policy tight enough “for long enough to restrain economic activity”, the Fed “will eventually loosen up the labor market sufficiently to push wage inflation down to the 3% to 4% range consistent with their inflation objective”. Switching to the horse’s mouth, Mr. Kashakri noted in a recent essay (a half-hearted mea culpa on inflation) that current high nominal wage growth “is inconsistent with our 2 percent inflation target given recent trend productivity growth” and assured readers that “Monetary policy is the appropriate tool to bring the labor market back into balance.” (Mr. Kashakri, sticking with his golden hammer). Finally, while there were several interesting tidbits from the Fed minutes (including the apparent fear that “an unwarranted easing in financial conditions… would complicate the committee’s effort to restore price stability”), the committee noted “that risks to the inflation outlook remained tilted to the upside” with the “possibility that price pressures could prove to be more persistent than anticipated, due to, for example, the labor market staying tight for longer than anticipated”.

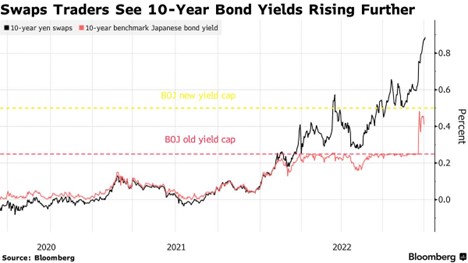

P.S. The BoJ’s latest thumb is sending the Japanese bond market in (presumably?) the wrong direction. This article notes that the BoJ’s “decision to double its 10-year yield was meant to improve market functioning. So far it’s triggered even heavier intervention from the central bank, threatening to reduce liquidity further in the local bond market”. The wild bond moves have led the BoJ to announce several unscheduled bond buying operations amid “more bets from traders the BoJ will lift its cap further or scrap it altogether as inflation picks up in Japan”.

P.P.S. How’s the household sector according to the Fed minutes? Depends on the “participant”.