“Assumed the enactment of…additional fiscal policy”

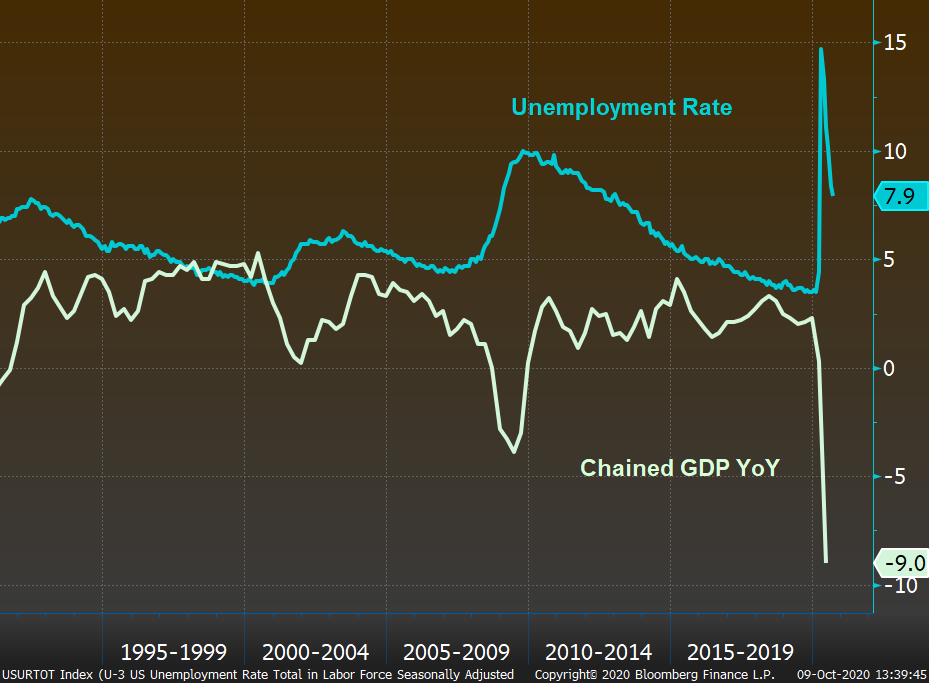

In the famous joke about the physicist, engineer, and economist stranded on an island, the economist delivers the punchline by assuming a can opener, saving the day even if only in theory, rather than practice. While the joke can offer some amusement, it becomes less amusing when it becomes reality (thanks Yogi Berra?). Enter the Fed minutes from the September meeting. The good news is Fed staff projections in September saw improvements in both the rate of GDP growth and declines in unemployment. The bad news is the projections assume a can opener in the form of additional stimulus: “staff’s forecast assumed the enactment of some additional fiscal policy support this year; without that additional policy action, the pace of the economic recovery would likely be slower”. The underlying need for more stimulus is nothing new for those following the job market (as we discussed last week), but the message may have finally gotten through considering the continued frantic back and forth. “Help us Congress, you’re our only hope!”

“Restructuring in some sectors”

Beyond just the need for the fiscal can opener, “participants raised concerns regarding the longer-run effects of the pandemic, including how it could lead to a restructuring in some sectors of the economy”. While the “participants” may yet be holding out hope, there is a continuing drumbeat of data indicating that “could lead” in the above should be replaced with “has led”. Case in point, Microsoft is joining the list of companies upping flexibility in their work from home policy, and with more companies either allowing work from home flexibility, or reducing staff outright, further cracks are beginning to show in commercial real estate. Data from Trepp gives a glimpse into these cracks. CRE “loans in bank portfolios are showing stress related to the economic downturn and signs that some borrowers are already y expecting to default on their mortgages”, with a number opting for “strategic default”. In Office CRE, “landlords have been providing more concessions to their tenants”, with deal-sweeteners now at levels that “closely resemble the uptick seen during the 2009 Great Recession”. Although the growth in office CMBS delinquencies has “remained contained relative to that of other property type categories since March”, some borrowers have tenants who are unable “to pay rent in the short-term”, and “sector headwinds” remain.

P.S. In the latest Hoisington Management Quarterly, Lacy Hunt expands on the dynamics he discussed earlier, explaining why “monetary policy is left with one-sided capabilities” and the perils of the “debt trap”.