“Too early to think we have this virus beat”

With another week has come another round of headlines about the various heroes and villains in the CV-19 “battle”. While just last week there was heavy discussion about the various new strains popping up across the globe, there’s more news this week, with preliminary data showing that a UK variant, which looked to be more infectious but potentially less deadly, may in fact be more deadly. The preliminary data is admittedly mixed, and scientists are saying the “data is not yet strong”, i.e., it’s too soon to tell. But combine this news with Dr. Fauci (who has recently returned to hero status as White House health advisor) warning that vaccines may not be as effective against the new strains, and one has a recipe for pessimism. However, the recent decline in cases (which some such as ZeroHedge look at cynically) and a “slew” of other more advanced vaccines in the discovery pipeline make it clear that the “battle” continues.

In the meantime, Joe Biden is now installed in the Oval Office. As such, there are now pens being put to paper on relief measures, with Biden already issuing executive orders on student loans and evictions. However, for those looking for more stimulus, there are some villains who have popped up, including Senator Romney who was among those leading the charge for the December package, but wants to give the $900 billion package “some time to… influence the economy” and believes the latest proposal is “not well-timed”.

“Unconventional policy… has become a destination”

The last few weeks have also been an interesting time to watch the narrative develop around the modern economic “heroes”, central bankers. Axios ran an article two weeks ago saying “Criticism of the Fed goes mainstream”, but such criticism clearly hasn’t gained traction as evidenced by former Fed chair Janet Yellen being on her way to joining the Biden team as Secretary of the Treasury.

The Axios article quotes an interview Mohamed El-Erian did with The Market (whose excellent interviews we have cited here and here). In the interview El-Erian discusses how different market actors and central banks have stumbled into “unhealthy codependency”, with attendant misallocation of resources and other problems. But, while El-Erian acknowledges that the current state of affairs is a “paradigm that’s very difficult to exit from”, he does see some reasons why current trends could change”.

Some change may already be afoot. Insiders report that the BoJ may “consider scaling back ETF buying” in addition to “loosening its grip on yield curve control”. Aware of the dangers El-Erian discussed (“Every time, the central banks even hint at exiting, the markets become disorderly”), the BoJ will need to strike a “delicate balance”, aiming to give itself “more leeway” without “triggering a market sell-off”.

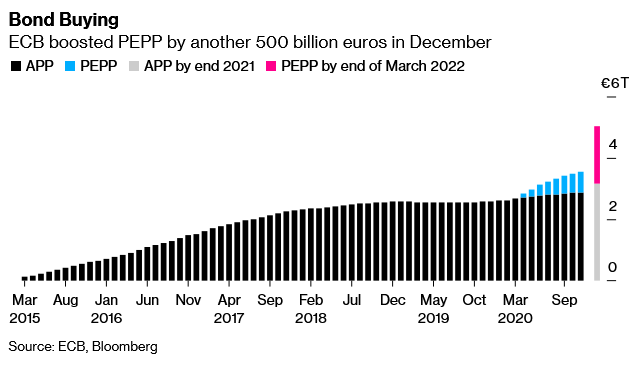

For those concerned that central banks are starting to change tack, (perhaps they are concerned that they are falling into the Nietzschean trap regarding fighting monsters?), it appears that the ECB is still embracing its role as market hero: its purchases of euro-area bonds this year “could exceed net issuance by almost 60%”.