Economic Music

With the beginning of the New Year has come quite the whirlwind of developments. From the kerfuffle in D.C. to the emergence of new strains of CV-19, the start of 2021 hasn’t been the denouement to 2020 that some might have hoped for. But while these and other events have caused reactions across markets, we’ve been listening for changes in the metaphorical music for a sense of whether the party continues and markets will keep on dancing.

“Just a down payment”

The Senate is in recess until January 19th, so additional stimulus before then is not something one would want to hold their breath over. But it is quickly becoming common knowledge that on the other side of Biden’s inauguration is a monster bolus of spending, that is if Biden’s comments that December’s $900B relief bill was “just a down payment” are any indication.

An opinion piece on the subject in the WSJ, “Welcome to the Era of Nonstop Stimulus”, ruefully reports that “spending didn’t speed the last recovery”, thanks in part to “Mr. Obama’s program of tax, spend and control”, and warns that “stimulus spending has nothing to do with good long-term economic outcomes”. The authors are of the opinion that “the case for another stimulus appears entirely political” and argue that “stimulus combined with an accelerating vaccination rate could in fact produce an overheated economy”.

A recent opinion piece from the Financial Times arrives at a similar conclusion about the inevitability of additional relief. In an article (alternative link) premised around the chance of an “economic reset” addressing “increasingly grotesque” levels of inequality, Gillian Tett argues that Democrat control of Congress “is a game changer”. Tett says, “Investors should expect more stimulus packages [ Yes, plural -Ed.] soon”, including relief for households and small companies, infrastructure spending and student debt relief.

Interestingly, despite the difference in sentiment over the likely policy of a Biden administration, the articles share some similarities. Both articles have some reservations about what increased levels of debt/GDP could mean, though this, as we now know courtesy of Larry and his merry band, isn’t a problem. However, both also say in no uncertain terms that, returning to the metaphor, the party isn’t over.

“Waiting for… the music to stop”

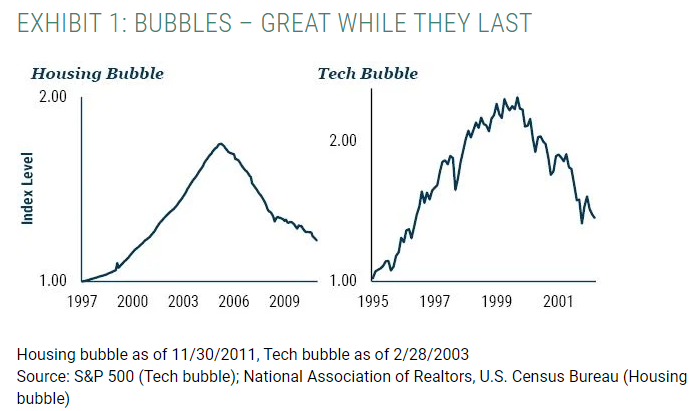

Though the music is still playing, there is some worry that things are, in a word, “frenzied”. ( Aside: Elon Musk is, as of writing, now the “world’s richest person”, “How strange”). GMO’s Jeremy Grantham gives an account of some of the current market dynamics in a recent piece, “Waiting for the Last Dance”. Grantham describes both how bubbles form as well as how they end and explains the dynamics that increase his confidence “that this is indeed the late stage of a bubble”. Yet, despite laying out a case for how the current bubble could be pricked, he encourages reader to “remember that timing the bursting of bubbles has a long history of disappointment”.