“All the more impressive”

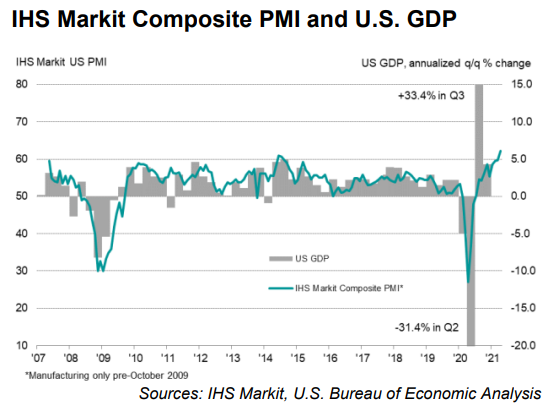

The momentum of the Usual Suspects continues this week, with various measures of inflation and activity hitting new highs. Case in point, the Kansas City Manufacturing Index saw its highest reading on record for both its monthly composite and its index of prices paid for raw materials. This superlative performance was echoed in the IHS Markit Flash U.S. Composite PMI. Chris Williamson, Chief Business Economist at IHS Markit, commented that “the upturn is broad based: the service sector is growing at the fastest rate recorded in almost 12 years of survey history, and manufacturers reported one of the strongest expansions seen over the past seven years”. Additionally, Williamson noted that the performance seen in manufacturing was “all the more impressive, as factories continued to be throttled by unprecedented supply chain delays”. This was an echo of the comments highlighted in the Kansas City Manufacturing survey, where respondents reported a variety of supply chain problems, especially in steel, and significant labor issues. Continuing the trend, semiconductor shortages persist in dogging a number of industries, and Intel warned that tightness could “stretch two more years” following its latest earnings report.

“Drunk people staggering around”

All of the inflationary data is increasing Larry Summers’s level of worry. In a webinar hosted by the Council on Foreign Relations, Summers, who was already among the voices expressing some caution about the potential for inflation, laid out three factors causing him concern. The first, that the Fed was going to leave forecasts behind and adopt an outcome-based approach, Summers compared to a host at a party who waits to take the punchbowl away until “we see a bunch of drunk people staggering around”. Summers also expressed doubt about the Fed’s confidence it can keep inflation under control and worried about the Fed’s “exquisite sensitivity to the possibility of a meaningful asset price decline”. On the issue of controlling inflation, Powell reiterated his view that the Fed had the tools to “address such pressures if they do arise” and does not “seek inflation that substantially exceeds 2 percent, nor do we seek inflation above 2 percent for a prolonged”.

Meanwhile, there’s a continued emphasis on the need for the Fed to address inequality. As the Washington Post wrote in an article on Powell, the Fed Chair has “referred to the tent city [he passes on the drive to work] three times in the span of seven days” and there are questions of “what more could the Fed have done to reach the most vulnerable during this recovery”. While the Fed’s argument has generally been that keeping interest rates low to allow for a positive feedback loop that eventually leads to “faster growth in wages and income”. But there is a growing murmur of voices saying that the Fed is hamstrung by their tools. As Claudia Sahm is quoted by the Washington Post, “some of the problems they’re trying to solve, they make a little bit worse” and while they may not like Elon Musk more than Walmart employees, “the reality is that their tools make him better off more quickly than the worker”. This is supported by a recent report from researchers out of Copenhagen who found that, at least in Denmark, “gains from lower policy rates exhibit a steep income gradient, with the increases in income, wealth and consumption modest at the bottom of the income distribution and highest at the top”. All of this points to a Fed that may indeed wait until they see the whites of inflation’s eyes, but it may also be a sign that more policies to reduce inequality, à la the proposed increase in the capital gains tax, may be on their way down the pike.