“Expectations of future inflation hit a record high”

A few weeks ago, we went point-by-point through part of Jerome Powell’s Jackson Hole speech, addressing why the Fed may be overly optimistic in its belief that inflation will be “transitory”. Yes, CPI YoY retreated slightly, and high-flying used car prices “fell 1.5% in August”(“but are still up 31.9% year on year”). However, while the slight decline in both headline and core CPI may be one point to the “transitorians”, this week saw the release of more data showing that it is still too soon to call it.

Regarding inflation expectations, even Larry Summers is starting to chide the Fed, wondering how the Fed can “assert that inflation expectations are remaining anchored in the face of evidence from its own survey”. In his tweet, he cites a WSJ article on the New York Fed’s Survey of Consumer Expectations. As the Empire Fed’s press release highlighted, “short- and medium-term inflation expectations rose to new series highs”. What’s more, consumers’ expectations rose for some of the more visible items, including food, rent, and gas prices, which consumers now expect to increase 7.9%, 10.0%, and 9.2% YoY, respectively. (Gas prices appear to be a particularly sensitive subject, inspiring comments from President Biden during a recent speech).

The outlook for ongoing inflation is itself continuing another trend we’ve highlighted. As the University of Michigan’s Consumer Sentiment survey shows, consumers continue to sour over the price of durables, vehicles, and homes, with buying conditions for “all three near all-time record lows… with the declines due to spontaneous references to high prices”. However, the Michigan survey did show some slight cooling in consumers’ inflation expectations, in contrast to the Empire Fed’s survey discussed above.

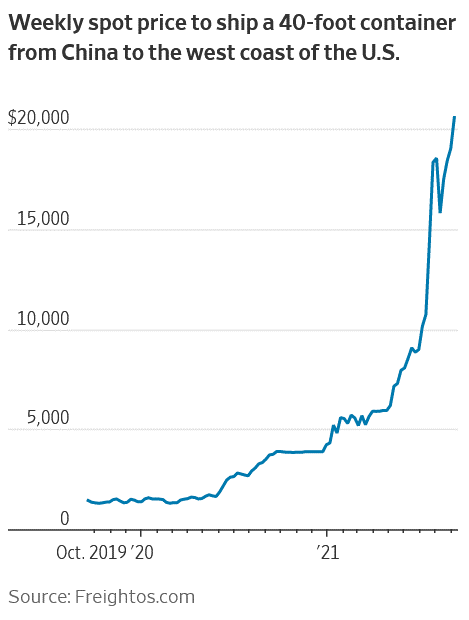

Another of Powell’s points was refuted by the disruptions in supply chains, and, unfortunately, these issues are ongoing. The Empire Fed’s Manufacturing Survey Delivery Times Index reached a new high, the container ship queue off of California continues to make headlines, and transportation costs remain a ”supply-chain hurdle” as shipping rates for certain routes are “five times higher last week compared with the same time last year”.

P.S. Two weeks ago, we looked at the “profound transformation” underway in China as it undergoes “people-centered change”. This week, there’s more grist for the mill. A new defense alliance, “AUKUS”, was announced, which includes the sharing of nuclear-powered submarine technology and inspired a chippy response from the CCP’s English-language Global Times.

P.P.S. You can find Julian’s views on China and much more in his interview from this week with Trevor Hall of Mining Stock Daily.