The release of the FOMC minutes this week introduced a little bit of chaos as headlines trumpeted that a taper would likely begin this year, only to be followed by backtracking and caveats. The minutes themselves show that the Fed is wary of the price it will pay should there be a misstep, admitting that “a tapering announcement that was perceived to be premature could bring into question the Committee’s commitment to its new monetary policy framework”. Additionally, as they consider their options, they are aware that “alternative tapering approaches could have significant financial and economic effects not fully captured in the staff’s standard empirical framework”. Thankfully, reputational and tactical questions aside, we got two regional Fed surveys hot off the press as we head into next week’s Fed conference in Jackson Hole.

The first, the Empire Fed’s Manufacturing Survey was broadly positive. Yes, the results showed slower growth, but activity continued to expand, and there was “ongoing optimism” about future conditions. As has been the case recently, the price indexes were standout readings, with prices paid holding steady and the prices received index setting a new record.

The Philadelphia Fed’s Manufacturing Business Outlook Survey was generally in the same camp as the Empire Fed. The data were mixed, with current indicators remaining positive (except inventories, which continue to decline) and firms’ outlooks softening but still expecting growth. However, prices received was superlative, jumping to “its highest reading since May 1974”. What’s more, the special questions were appropriately aimed at firms’ price expectations over the coming year. Firms broadly forecast more of the same: the median expectation for their own prices was a 5.0% increase, a 4.0% increase for compensation costs, and an overall inflation rate for “U.S. consumers” of 5.0%.

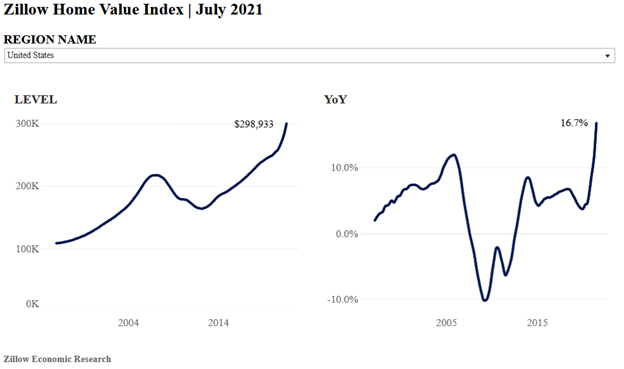

P.S. On the housing front, while Zillow’s latest data shows that rents continue to push “beyond where they were projected to have been if pre-pandemic trends had held”, the good news is “there are signs that the market may be nearing the peak of home price appreciation”, including an increasing share of listings that experienced a price cut and steady to increasing median times homes are staying on the market.