“If the model turns out to be wrong…”

Jerome Powell avoided playing Godot in his speech at Jackson Hole last week, delivering the much-awaited conclusion of the policy review and announcing “unanimous” changes to the Statement on Longer-Run Goals and Monetary Policy Strategy. As it turns out, the dual mandates need Flexible Average Inflation Targeting (FAIT)? FAIT, what is it? In addition to Powell’s speech, others have spoken up to explain the new strategy.

During a Peterson Institute webcast on Monday, Vice Chair Clarida gave a speech that was very similar to Powell’s. After some background preamble, Clarida dove into the dynamics of r* and noted the potential difficulties when policy rate is “constrained by its ELB [Effective Lower Bound]”. However, the kicker was the explanation of the new reaction function. Clarida explained the reasoning behind aiming for “inflation that averages 2 percent over time” but went further to explain that models of maximum employment “can and have been wrong”. What’s more, “a decision to tighten policy based solely on a model without any other evidence of excessive cost-push pressure that puts the price-stability mandate at risk is difficult to justify, given the significant cost to the economy if the model turns out to be wrong”. With the Philips Curve presumed dead, it appears the Fed is going to wait to see the whites of inflation’s eyes.

Perhaps this is what noted Fed dove and lumberjack Neel Kashkari, having previously mocked maximum employment watchers, has been trying to advocate all along. Kashkari explained his take on Fed policy in an interview recorded before Powell’s Jackson Hole speech, talking with Bloomberg’s Joe Weisenthal and Tracy Alloway. Kashkari’s views are in line with Clarida’s, summarized as “Instead of hiking rates when the models say you should anticipate inflation just because the unemployment rate has fallen below some number, the Fed actually wants to see the inflation first”.

Fed Governor Lael Brainard provided further clarification in her speech today during a Brookings Institute webcast. Brainard emphasized the “important change in the Committee’s reaction function” and echoed Powell’s argument that a rigid rule on AIT was not appropriate, explaining that “a mechanical AIT rule is likely to become increasingly difficult to explain and implement as conditions change over time”. This makes FAIT “better suited for the highly uncertain and dynamic context in which policymaking takes place”.

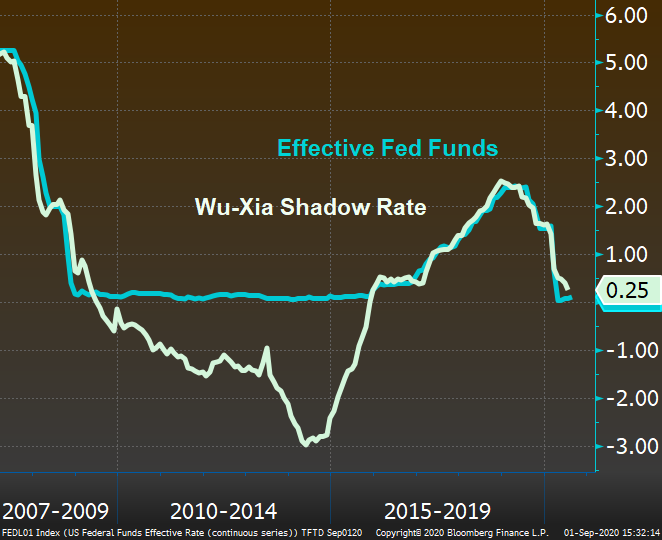

PS While the talk of the town has been the strategy review, the Wu-Xia Shadow Rate is back and showing that even with rates at rock bottom levels, the alphabet soup of (lightly-used) facilities and asset purchases haven’t been able to push the shadow rate negative. The Fed is going to need a bigger boat if they want to push beyond the ELB.