“Another new record high”

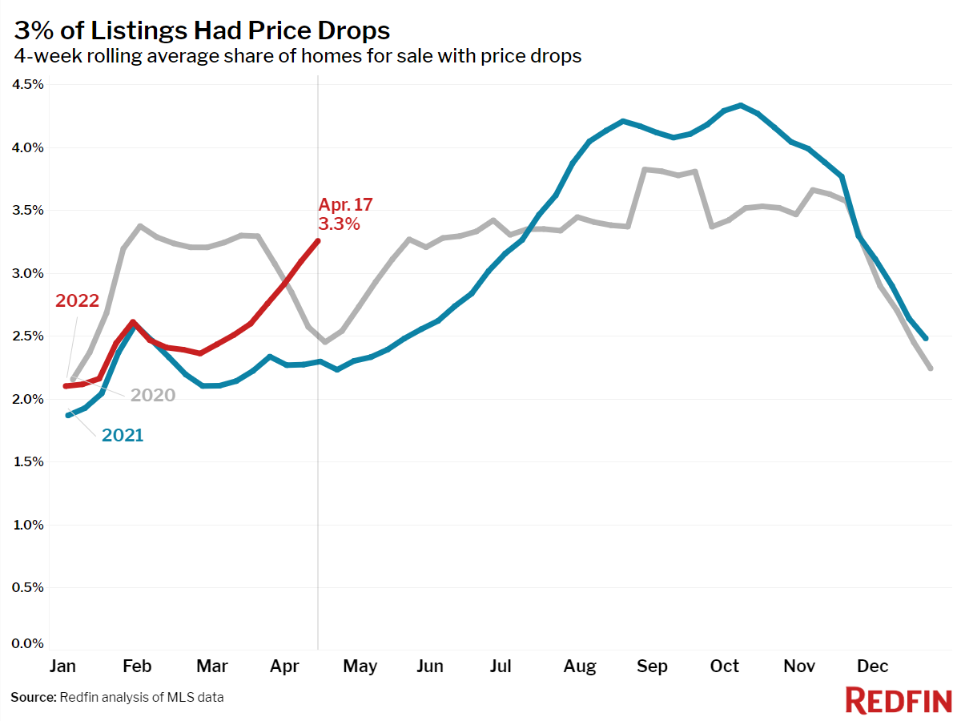

Over the last few months, there have been continuing hopes of “cooling” in the housing market, which this week came in the form of recent data from Redfin. Covering a variety of indicators, the company’s report noted that there are signs of faltering demand, including a reduction in Google searches, a drop in requests for home tours, and a decrease in the number of mortgage applications for purchase. What’s more, Redfin is “closely watching the accelerating share of home listings with price drops, which is climbing at its fastest spring pace since at least 2015, another sign that demand is not meeting sellers’ expectations.” This point was clarified in another article from Redfin, which noted that “roughly 1 in 8 sellers cut their list prices during the four weeks ending April 17—the highest share in five months”.

But it’s too early to pop the champagne. Countering the idea that housing market tightness has passed, Redfin’s Chief Economist notes that “the sharp increase in mortgage rates is pushing more homebuyers out of the market, but it also appears to be discouraging some homeowners from selling. With demand and supply both slipping, the market isn’t likely to flip from a seller’s market to a buyer’s market anytime soon”. At the same time, amidst slowing home sales and the climb in mortgage rates that has meant “the cost of financing a home [is] about 40% higher than a year ago”, home prices continue on their tear: “the median home-sale price is up 17% year over year to a record $392,750”. And those opting to find a place to rent won’t find much relief. As both Redfin and CoreLogic data show, rents too are on a tear. Redfin reported that median asking rent had climbed roughly 17% YoY in March, while CoreLogic’s slightly older data showed that rents had grown 13.1% YoY in February.

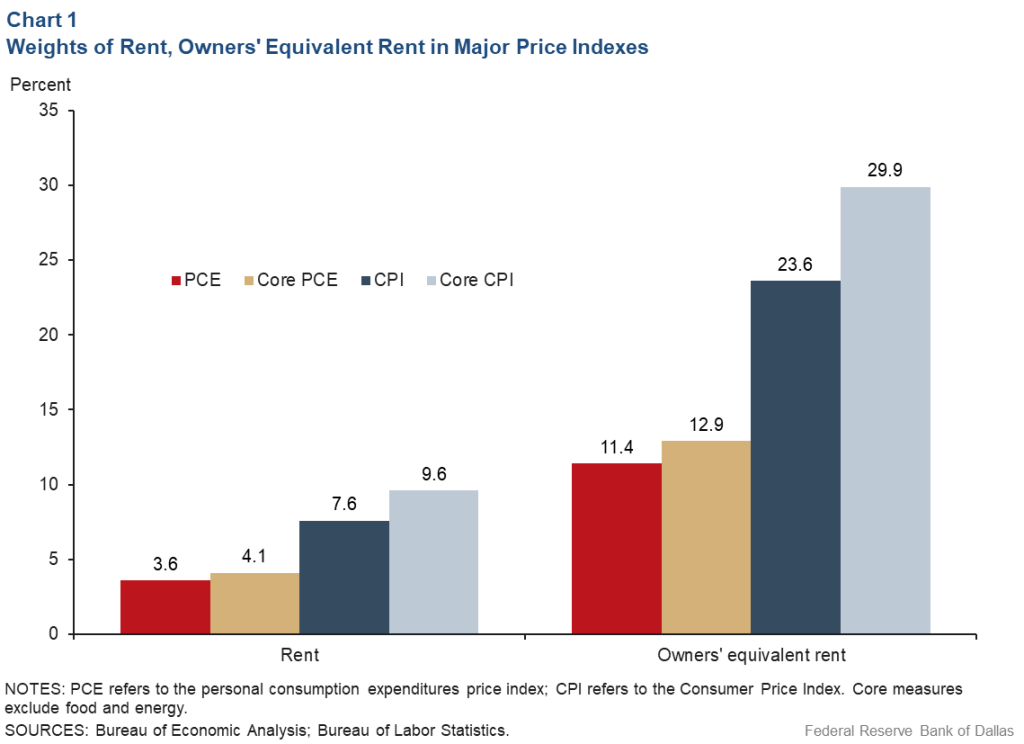

As a reminder, housing is a hefty part of various inflation measures, yet another reason why “it ain’t over until it’s over.”

P.S. While several Fed speakers were out this week touting the FOMC’s ability to engineer a soft landing despite being “behind the curve”, Hoisington (whose Lacy Hunt opined on “inflationary psychosis” in 2021) published their latest Quarterly, noting that “Monetary restraint has resulted in recessions in all but 10% of the cases since the Fed’s founding in 1913.”