“A stunning loss of confidence”

Many of the headlines going into the end of this week focused on the horrendous results coming out of the University of Michigan Survey of Consumers. The headline Index of Consumer Sentiment saw a precipitous drop, one whose magnitude has only been surpassed “in six other surveys, all connected to sudden negative changes in the economy”. What’s more, the losses in confidence “were widespread across income, age, and education subgroups and observed across all regions”. The survey report pointed to “the pandemic’s resurgence due to the Delta variant” as a legitimate reason to expect “that the economy’s performance will be diminished”. But it went further and asserted that the soured mood “also reflects an emotional response” and was helpful enough to point the curious to their January 22nd report, “The Impact of Emotions on Expectations”. Looking through the current consumer outlook, Richard Curtin, the Surveys of Consumers Chief Economist, was hopeful about the months ahead, writing, “it is likely that consumers will again voice more reasonable expectations, and with control of the Delta variant, shift toward outright optimism”.

The underlying cause of potential economic weakness and gloom aside, the survey’s own Featured Chart gives a glimpse at what may be underlying the economic pessimism. Income uncertainty increased slightly while consumers are becoming increasingly disenchanted with high prices (see this week’s CPI and PPI). However, given Monday’s JOLTS numbers and the latest SBOI data (discussed below), consumers may be overly pessimistic about their future income.

“Losing confidence”

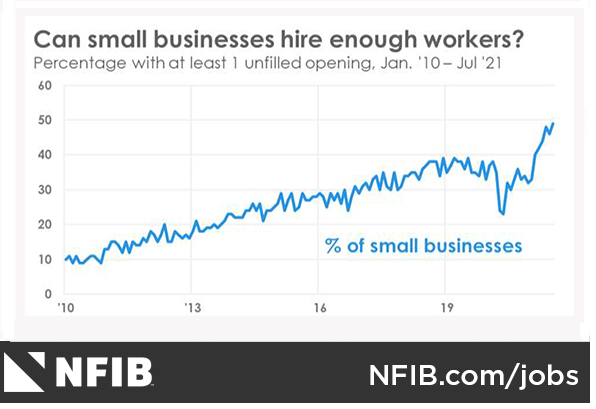

Like the Michigan survey, the NFIB’s July Small Business Optimism Index dipped and, superficially, appear similarly dour. “Small business owners are losing confidence in the strength of the economy”, writes Bill Dunkelberg, NFIB Chief Economist. This was evidenced by drooping sales expectations, a decrease in the number of respondents expecting better business conditions, and a drop in profit trends. However, despite these negatives, companies appear to be optimistic enough to be investing in human capital. A 48-year record high number of small business owners reported job openings that could not be filled, and a record net percentage of owners plan to raise compensation in the next three months. As has been the trend of late, supply chain issues, low inventories, and price pressures remain a problem, but if employers are looking to hire and retain workers despite a negative outlook, they may be tipping their hand. Like Andrew Carnegie, we’ll once again be paying more attention to what these businesses do rather than what they say.