“Nothing is Stopping Them Except for Finding Qualified Workers”

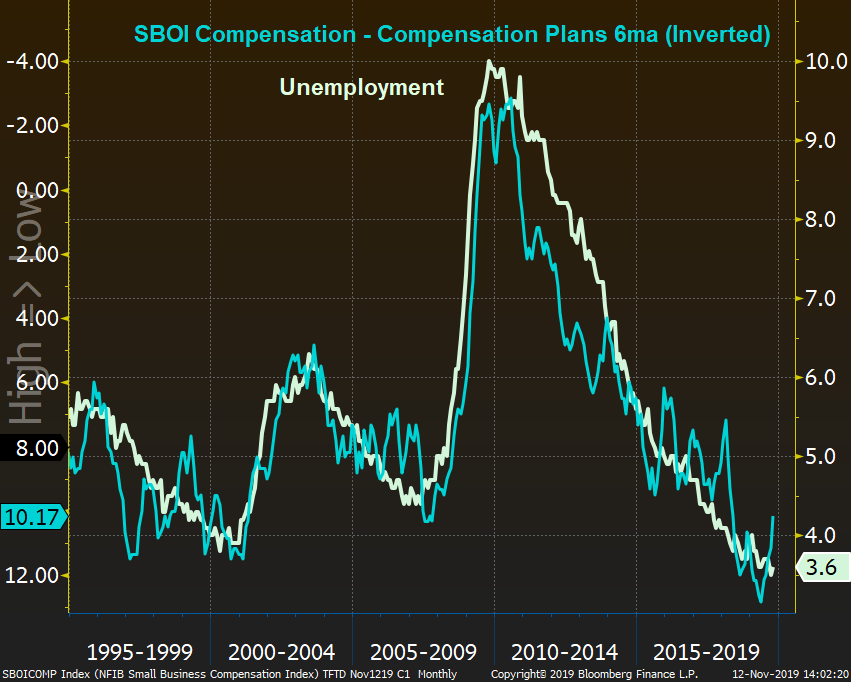

In the latest SBOI report from the NFIB, Juanita Duggan, NFIB President and CEO argues that while the “continued focus on a recession by policymakers, talking heads, and the media clearly caused some consternation among small businesses in previous months”, “it’s become clear that owners are not experiencing the predicted turmoil”. Instead, small business owners are doing well “thanks to tax cuts and deregulation”, with only a lack of qualified workers holding them back. The survey data weren’t particularly striking. The Optimism Index rose 0.6 points to “a very solid” 102.4, “with 8 of the 10 Index components advancing”. Additionally, the employment data points to a positive environment for employees, with no signs of rising inflation on “Main Street” but rising compensation and increased frequency of plans to raise compensation. While the data was simply lukewarm, the NFIB’s commentary echoed Duggan’s firm statement.

- “The economy is doing well given the labor constraints it faces”.

- “The economy will be steady at its current level of activity for the next 12 months”

- “Only a major unexpected disruptive event can dent the economy in the near term.”

“Too Much Money Chasing Too Few Deals”

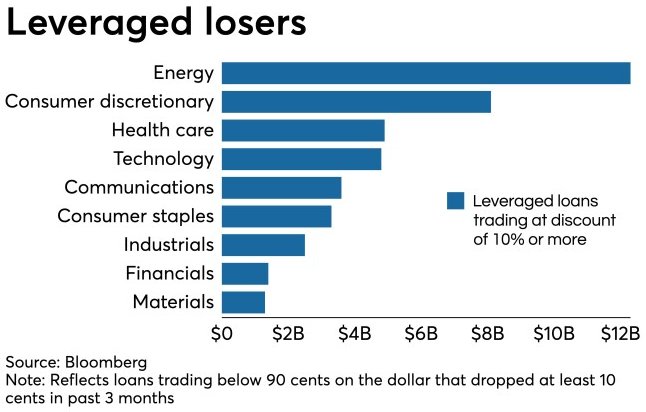

Though small businesses and the aspects of the real economy they reflect may be doing well, there are signs of things amiss in the financial plumbing. In addition to the continuing repo facility, which was trumpeted to be “in every way, shape and form an emergency measure”, Leveraged Loans and CLOs are making pundits nervous. In early October, an article from Bloomberg on the American Banker highlighted that leveraged loans are “staging their own private meltdown”, with big losses on loans coming “in just three months”.

The CLO market is also “Flashing Warning Signs”. In an interview in October, Bloomberg’s Katherine Doherty argued that the problem is “credit specific”, where loans trading at par “overnight have lost, 40, 50% of their value”, “and when that happens, it can sometimes trigger further downgrades”. This, in turn, can cause a chain reaction of selling. Doherty argues the heart of the problem is “the restriction of how much of CCC debt” CLOs can carry. While this is the proximal “heart of the problem”, the real issue is better explained by Howard Marks. In his September 2018 memo, “The Seven Worst Words in the World”, Marks walks through the simple supply and demand dynamics that have “created the current investment environment”. Marks then follows those dynamics through lending markets, showing how they have led to decreased quality of debt, higher levels of risk, and decreased levels of return, all while the amount of debt has ballooned. While Marks is “not describing a credit bubble or predicting a resulting crash”, he does think it’s an environment “in which investors should emphasize caution over aggressiveness”. For those looking for a more recent take, Marks spoke at a Bloomberg conference last week, where he reiterated his stance, “I do think that I feel very comfortable saying that this is the time to have less risk that normal in your portfolio”.