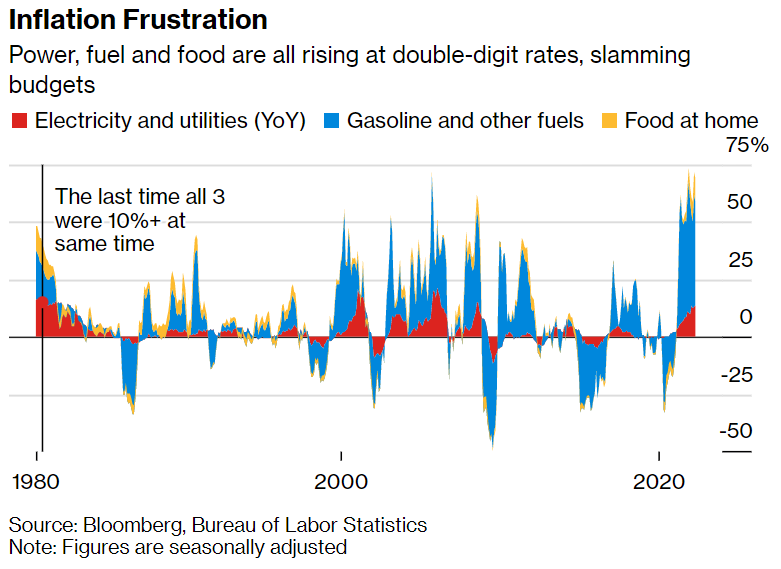

“No sign of a peak in inflation yet for households”

As the Fed shifted away from parroting the idea that inflation would be transitory, it held on to the idea that while inflation was persistent, it would soon peak and return to normal levels. It now appears that whatever peak they saw in the distance may have been a false summit. As this Bloomberg article explains, “for two straight months, the primary consumer expenses – fuel, power, and grocery-store food – have all been rising at double-digit annual rates for the first time since 1981” (related, home prices were up 20.6% YoY in the latest CoreLogic data).

Having used a little reverse psychology ahead of last week’s job numbers, the Whitehouse said it expected CPI to be “elevated”, and Biden “has warned that despite his efforts, high prices will be here to stay for a while”. Yellen was equally direct, saying during her testimony in front of Congress that she expected inflation to remain high, but added, “I very much hope that it will be coming down now”.

Mohamed El-Erian, who has been broadly on the button on inflation and policy, also predicted higher prints. In an interview with Bloomberg, he said, “Those who boldly said inflation has peaked and is coming down may have to change their minds”. Additionally, while his outlook for this month’s month-on-month CPI print is in line with expectations, the commentator said, “it wouldn’t surprise me if we see a headline print higher than 8.5%”, explaining that “the drivers of inflation are broadening” (a dynamic that the ECB noted as well, “inflation pressures have broadened and intensified”). What’s more, the commentator added that “Stagflation is my baseline.”

Christine Lagarde and company at the ECB are also on the lookout for higher inflation. Now firmly in the camp that risks to their inflation outlook are “primarily on the upside” and, despite the “great uncertainty”, the ECB signalled it “was likely to raise rates by half a percentage point in September, in addition to a planned quarter-point rise in July”. Trying to stem the tide, policymakers appear to be working on the buyers’ cartel idea floated previously, among other schemes, in an attempt to “balance efforts to cut off Russia’s revenue from its energy sales while shielding the global economy from a possible recession”. Though hope springs eternal that some mechanism may be found to achieve both a calming of energy markets and a staunching of the flow of money to Russia, Wolfgang Munchau, formerly of the FT, writes that “we are all too connected to be able to impose sanctions on each other without incurring massive self-harm”.

P.S. If there was any confirmation needed that prices at the pump are getting out of hand, like catalytic converters, thieves are now setting their sights on gasoline.

P.P.S. Stitch Fix now joins Carvana and others, announcing it is “laying off 15% of salaried positions within its workforce”.

Announcement from MI2 Partners:

We value your opinion and would love to hear your thoughts about our weekly newsletter. If you haven’t already, please help us improve your experience by sharing your feedback in a quick survey that will be sent to your inbox shortly. Complete the survey by June 16th to be entered for a chance to win a 6-month FREE subscription to our Institutional Research.