“Are markets ahead of themselves? Not for me to say”

While the title of this week’s newsletter might seem like either a summary of what we’ve covered over the last few months (with some supply chain thrown in for good measure) or the lamentations of the market’s Jan Brady, it is instead a direct quote from the ECB’s Christine Lagarde. Speaking at the press conference following the ECB’s policy meeting, Lagarde explained that the topic “occupied a lot of our time and a lot of our debates”. Rightly so considering some of the recent data out of Europe, where Advanced CPI hit 4.1% YoY (beating estimates handily) and where YoY PPIs across the continent have come in white-hot: German PPI was 14.2%, French PPI hit 11.6%, and Spain saw an eye-watering 23.6% increase in Producer Prices, all of which are at least 30-year highs! Lagarde correspondingly tacked slightly away from the “transitory” line, à la the Fed speakers we discussed last week, stating that “the current phase of higher inflation will last longer than originally expected”. She didn’t fully concede the point, though, asserting that “we expect inflation to decline in the course of next year” and saying that the Governing Council continues “to foresee inflation in the medium term remaining below our 2 percent target”.

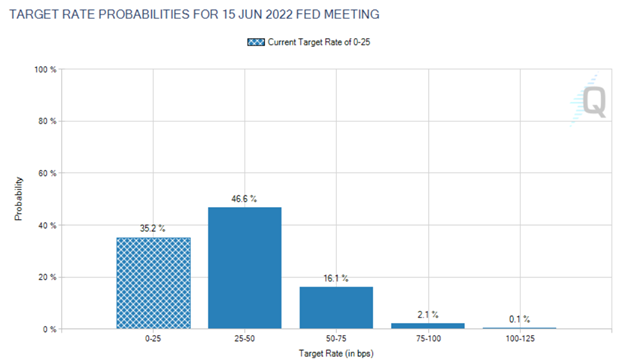

Whatever the ECB and Madame Lagarde see in their crystal ball, the markets and other central banks have their own ideas. As this article on the ECB’s meeting highlights, markets are pricing “an interest rate hike next October”, and there are other moves afoot around the globe. As this article explains, Australia’s RBA “declined to defend its 0.1% target for the key April 2024 bond”, and futures are “pricing in a hike in the 0.1% cash rate to 0.25% as early as April, while swaps have rates above 1% by year-end”. Rates and the central bank are also on the move in Canada, where the BoC announced it would “shift its quantitative easing program to… a reinvestment phase beginning Nov. 1” and “could raise its benchmark overnight interest rate sooner than it previously anticipated”. Even the US has seen a shift in expectations since this time last month, with markets now pricing in a better than 50% chance of a hike by the June meeting, as shown in the CME’s FedWatch Tool. Admittedly, some of the market moves we’ve seen recently may be a function of nonlinear effects as market participants find themselves offside or being squeezed by gamma (which appears to be an ever-present danger in today’s markets). But “real” or not, the moves will have hit the radar of central bankers as they head into their next meetings. Once again, action’s to you, Chair Powell.

P.S. Both Larry Summers (in tweet form) and Mohamed El-Erian (in article form) spoke out recently about the dangers the Fed faces if it holds too tightly to the idea that inflation will decelerate back to its 2% target.

P.P.S. MI2’s own Harry Melandri spoke this Thursday on Real Visions’ Daily Briefing, diving into the recent bond market moves, the dollar, inflation, and more. You can find the video and transcript here.