“Nowhere to hide”

Inflation made a big splash earlier this week, with Headline CPI’s YoY and MoM readings (9.1% and 1.3%, respectively) beating forecasts. Though the Headline number continued its upward march, hitting the highest level since 1981, Core cooled slightly, beating expectations but dropping to 5.9% YoY versus the 6.0% reading in May.

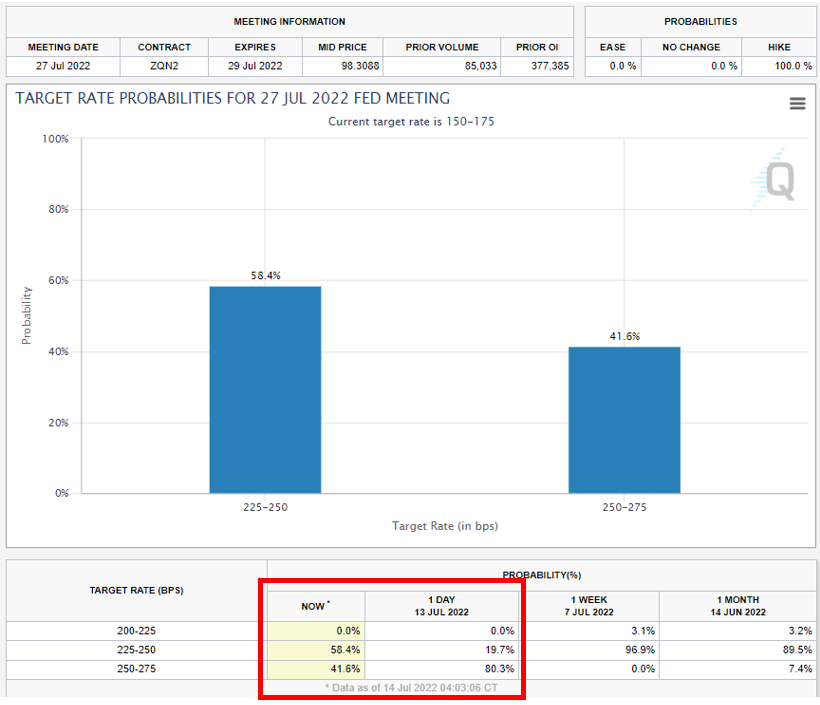

While these numbers in and of themselves are notable, especially regarding the strength and mood of the consumer (the Biden Administration was quick to note that the June CPI number was “out-of-date” and didn’t reflect the recent easing of gas prices), the numbers were also fodder for the Fed and Fed-watchers. As Nick Timiraos (the disseminator of the 75bps article before the last FOMC announcement) wrote, “Economists said Wednesday’s inflation report suggested the Fed will face pressure to continue big rate rises for a longer period”. Additionally, the three Fed officials who spoke Wednesday “didn’t say whether they would favor” a full percentage point move, “but they didn’t rule it out”. Today’s comments from Bullard and Waller put a damper on the talk of a full 100bps hike, saying, “they favored another 75-basis-point rate increase”.

“Nightmare scenario”

Following last week’s coverage of the European gas market, things appear to be taking a turn for the worse, with France’s Macron warning, “We need to prepare ourselves for a scenario where we have to manage completely without Russian gas”, and Germany’s Economy Minister, Robert Habeck, said Germany needs to prepare for the “worst-case scenario”. Those in Germany looking to (pardon the pun) branch out and use firewood for heat this winter may be out of luck. High demand has led to a “run on stoves”, and firewood dealers “can no longer meet the exorbitantly increased demand in many places”. This won’t be helped by individual countries, like Hungary, who are enacting export bans to try to shepherd their own resources.

Meanwhile, there was a kerfuffle recently over a turbine needed for Nord Stream 1. While Ukraine is less than pleased about the decision, Canada will return the repaired Seimens turbine after the Canadian Government issued a “time-limited and revocable permit”(Calvinball!) that would allow for the return of the turbine despite its sanctions against Russia.

P.S. Amid ongoing port problems and a ramping up of trucking issues, trains may also be a source of trouble, with a looming strike that could affect “115,000 railroad workers” unless the Biden Administration intervenes.

P.P.S. The situation for the housing market appears to be deteriorating, with yet more data from Redfin showing that “economic woes have already cooled the housing market, and they’re likely to continue dampening demand” and mortgage lender loanDepot announcing it would lay off nearly 5,000 employees “over the course of 2022”. What’s more, despite this cooling in the overall market, rent growth continues and will “likely keep inflation elevated”.