“Activity surged”

The latest Regional Fed surveys have continued the recent “business as usual” of elevated activity, price pressures, and strong employment readings. The Philadelphia Fed’s Manufacturing Business Outlook Survey showed strong but less aggressive growth. Respondents’ feedback “continued to suggest ongoing growth in the region’s manufacturing sector”, and “general activity, new orders, and shipments remain elevated but declined”. The Empire Fed’s Manufacturing Survey, also released last week, recorded even larger gains. Departing from Stephen King’s famous admonition about adverbs, the Empire Survey is chock full of “strongly”, “substantially” and “significantly”, but given the strength of the numbers, these are perhaps well deserved. “Business activity grew at a record setting pace”, “both price indexes were at or near record highs” and “the index for future employment edged up to a new record high”.

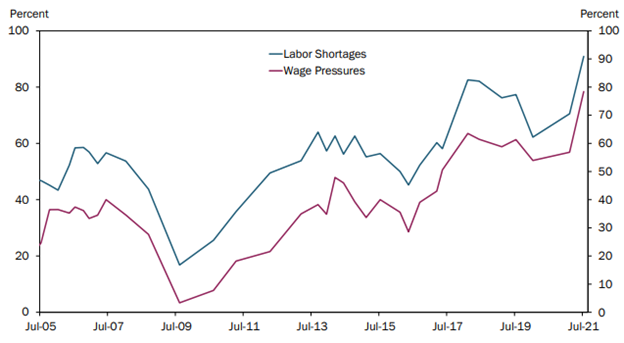

This week’s Kansas City Fed Manufacturing Survey was somewhere between the Empire and Philly Fed. Most of the month-over-month readings were strong, though down from their highs from earlier this year, including prices paid for raw materials and prices received. However, there were some records set in the prices indexes vs. a year ago, the number of firms reporting a shortage of workers, and wage pressures: “78% of firms reported having to raise wages more than normal to attract or keep workers”.

“Demand exceeds supply”

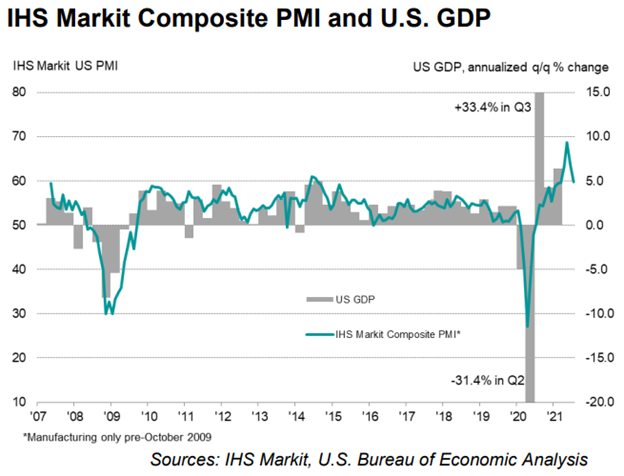

But it’s not just the Regional Fed Surveys that are showing continued economic strength. IHS Markit’s U.S. Composite PMI was also very strong, as companies “reported a further substantial expansion in business activity”. Echoing the ongoing theme of supply tightness, IHS reported that “the rate of growth eased for the second month running… as firms continued to report widespread capacity constraints”. Diving into the sectors, it was the IHS’s Services reading that held back the composite as “service providers recorded a further loss of growth momentum amid labour shortages”. Additionally, and unsurprisingly, “the rate of selling price inflation for goods and services remained historically steep” amid “higher raw material and transportation prices”. It is worth noting that the IHS’s respondents were somewhat gloomy in their outlook. Continued uncertainty about supply tightness and the delta variant “pushed business optimism about the year ahead to the lowest seen so far this year”.