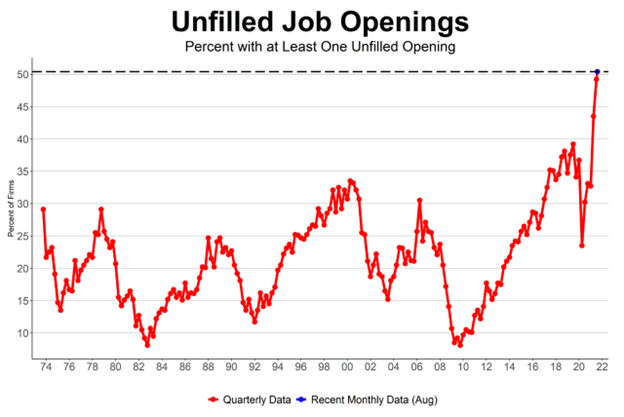

“More and more small businesses are struggling to find workers”

With a host of recent headlines on the strength of the labor market, today’s NFP release was a little bit of a letdown. There were net gains of 194k jobs, and unemployment fell to 4.8%, but there were expectations of nearly a half million jobs created in September. But before forecasters get too dour and wonder why they’ve been built up just to be let down, there are a few reasons to be optimistic. First, both August and July’s numbers were revised up. Second, as Yahoo explains, “the biggest drag to the headline payrolls figure for September came from the government… local government education jobs specifically fell by 144,000”. This may not seem to be a reason for optimism, but as the BLS report clarifies, “pandemic-related staffing fluctuations in public and private education have distorted the normal seasonal… patterns”, making “recent employment changes… challenging to interpret”. Finally, recently released survey data continues to show strength in the labor market. The ISM’s Services Report echoed some of the data from the ISM Manufacturing Report we discussed last week, with respondents saying “Labor shortages experienced at all levels”. And the NFIB’s Small Business Jobs Report had several records set across its metrics, including new highs in owners who reported raising compensation, in owners citing labor costs as their top business problem, and in the number of owners reporting job openings they could not fill. While the current state of the economy offers numerous examples of the dangers associated with equating supply to demand, these latest data indicate that the HR hires we noted last week may be busy for the foreseeable future.

“Cascade of problems”

Speaking of supply and demand mismatch, supply chains continue to have problems. While this certainly won’t surprise those who’ve been following our coverage of this issue, there continues to be a growing emphasis on it, with the problems inspiring the creation of new indices, such as Moody’s “Supply Chain Stress Index”.

But while the problems are nothing new, the second order effects are growing teeth. As a relatively mild example, the “current supply chain environment leaves retailers with limited options” according to a recent report on Costco, who announced that it was joining the likes of Walmart, Dollar Tree and Home Depot in chartering its own ships to transport goods. However, as an example of what’s playing out at a much larger level, the global energy crunch has rippled across continents, causing fears that the knock on effects could lead to “surging prices” that “hit economic growth”. Meanwhile, the rubber has metaphorically already met the road in the UK as high gas prices caused the shutdown of a fertilizer plant, which in turn lead to a carbon dioxide shortage that has affected everything from farming to packaging. And China’s own energy crunch, which has admittedly been exacerbated by its political decisions (partly in response to “AUKUS”), is likely to ripple through not only a variety of industries, but across borders, affecting “metal exporters such as Australia and Chile, and key trading partners such as Germany”. What’s the saying, “It’s all fun and games until there’s demand destruction”?