“Pause hiring for as long as this macro-environment requires”

While we had said, tongue in cheek, that the Fed’s new favorite word was “expeditiously”, it may instead, unfortunately, be “pain”. A case in point is Loretta Mester’s recent speech. During her talk Thursday, the Cleveland Fed president remarked that “labor markets are very tight” and, in line with Powell’s messaging, commented that “the current pace of wage increases is inconsistent with maintaining price stability.” With uncertainties and risks being “to the upside”, Mester warned that “if inflation has failed to moderate, then a faster pace of rate increases could be necessary”. What’s more, she cautioned that “removing policy accommodation to tighten financial conditions” “will take fortitude”: “This will be painful but so is high inflation.”

While Mester and company are emphasizing slowing down the labor market and some potential discomfort, Coinbase has joined Amazon and Carvana in helping the Fed reach its goal of labor market equilibrium. Having previously announced that it would pause hiring, Coinbase has taken things a step further and announced that it will “rescind a number of outstanding offers for people who have not started yet” (Coinbase may not be alone in rescinding offers if this post is accurate about Redfin).

But while the tech job market may be flashing warnings, other recent signals have been mixed. The ISM’s latest reading saw employment drop to 49.6, below the neutral 50 level, but the drop in the ISM reading appears to be more to do with a lack of supply than a drop in demand. The ISM’s Tim Fiore explained that there are ongoing “labor force constraints” and “Employment levels, driven primarily by turnover and a smaller labor pool, remain the top issue affecting further output growth”.

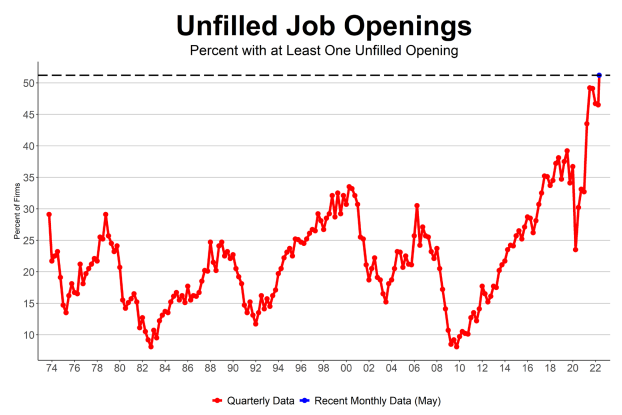

The NFIB’s latest jobs report data also run counter to the Fed’s “green shoots” and indicate continued labor market strength, with both the percentage of business owners reporting job openings and the percent of owners raising compensation at or a hairsbreadth away from record highs. Of note, however, is that while employment increased on average, “more small businesses reduced employment than increased”. And on a gloomier note, ADP’s payroll numbers were well below forecasts, and the Whitehouse may have insinuated that tomorrow’s NFP numbers may not be so hot, mentioning that it does not expect “blockbuster” job reports every month.

P.S. The ISM’s latest Semiannual Economic Forecast shows that both Manufacturing and Services are expected to expand, with both sectors expecting to see prices increase throughout 2022 by more than 1% beyond last month’s CPI reading of 8.3%.

P.P.S. BMO’s latest Financial Progress Index survey, which was admittedly conducted before May, found that “a quarter of Americans will need to delay their retirement” and “42% are changing how they shop for groceries” because of “inflation and rising consumer costs”.

Announcement from MI2 Partners:

We value your opinion and would love to hear your thoughts about our weekly newsletter. Please help us improve your experience by sharing your feedback in a quick survey that we sent to your inbox earlier today. Complete the survey by June 16th to be entered for a chance to win a 6-month FREE subscription to our Institutional Research.